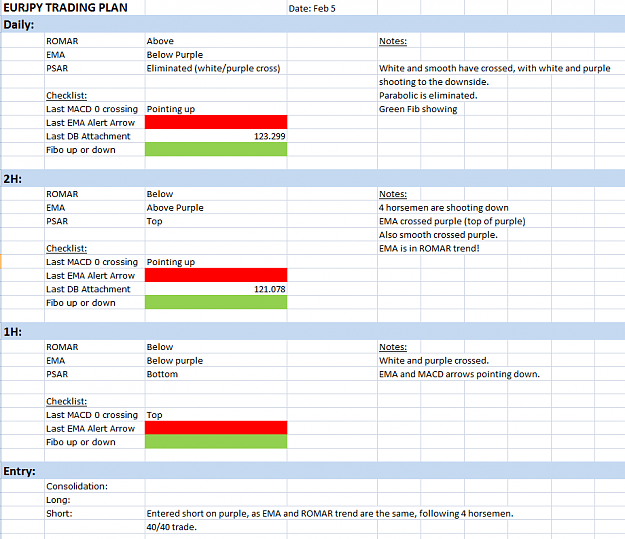

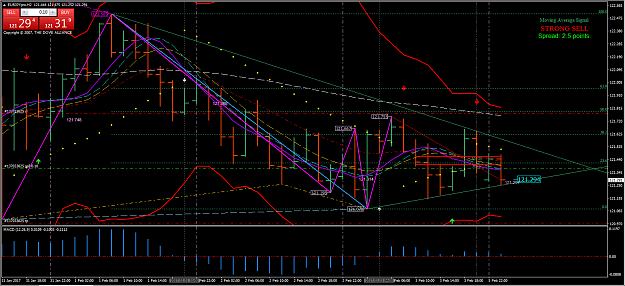

Disliked{quote} I closed the trade before friday's end, either win or lose this entry was bad: I entered long against romar on both H1,H2, candle didn't open above EMA/PURPLE, the risk for a slippage was high. I should have waited the market to decide what to do, in particular at, 61.8 fibo H2 resistance We had DB/SAR as signal for a retrace back to downtrend On the candle I entered in H1, white crossed purple as signal of starting the consolidation, candle opened below EMA. Waiting few minutes the EMA Alert would pop-up right before the candle I entered...Ignored

What made this trade bad is to do with two objectives.

1. The Parabolic

2. The SAR.

You made an entry totally against them both: which is called counter-trading. Because the market was in consolidation with your entry the only option at that time for an entry was with the SAR attaching with the Parabolic for 40 pips going down.

This is for everyone - traders are not using the SAR correctively. The SAR is used correctively with the Parabolic. An example is with this traders entry chart. The SAR broke away from the DB and attached with the Parabolic on the other side of Purple for entry going short. Bottom line - the SAR and Parabolic works together for all entries in consolidation and also on retraces in trends.

Any time you have trends you will have both the DB/SAR in the trend. Once you have a retrace pulling back to the other side of Purple, and heading for the Parabolic, you will also have the SAR detached from the DB and attached with the Parabolic (SAR - "Stop And Reverse") back into the trend.

At least you recognized your mistake and that is good.

The Dove - Forex Trainer

7