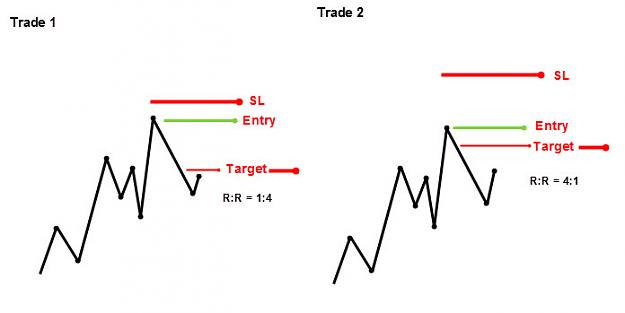

Disliked{quote} So if RR is useless how do you assess the each trade you make? p.s. your pessimism is far to entertaining for you to be on my ignore list.Ignored

1) Each trade is independent from the previous one

therefore

2) R:R cannot be preset but "comes out in the wash" - it's a statistic, not a driver.

Painstakingly calculating your RR when it is positive gives you that warm and fuzzy feeling that may be you are onto something... only to be proven very wrong after the next trade or two.

RR was created by Mr. Tharp so that he could sell books and speaking engagements...

How can you be certain or your risk-reward ratio when the outcome (reward) is a random event?. The risk can be known but never the reward. Therefore you can never rely on the current expectancy for the future. Mr. Tharp's work has the appearance of solid math and logic but is totally useless in actual practice.

2