Disliked{quote} Thank you Mr. Fisher. Your results clearly show that this strategy has worked well for youDo you use any tool to scan the 28 pairs ? I came across a tool called Angulator which uses TDI. I do not know yet if that is going to help me catch a move on specific pair. I do agree that there is no alternative to personally eye-balling higher time-frame of each pair in deciding which to act on.

Ignored

There is no magic tool or indy, because they are all lagging. Even PVSRA if we wait for M15 trend confirmation ( denmas is usually not, but he has excellent money management and not many traders have that, so TOP/BOTTOM picking can be very dangerous.

I see a problem here if you want to use the indy you mentioned as entry trigguer...IT IS LAGGING- especially because you mentioned you are trading H4. I do not know you very good yet and have no idea about your trading expirience or history, so I will comment for traders in general here.

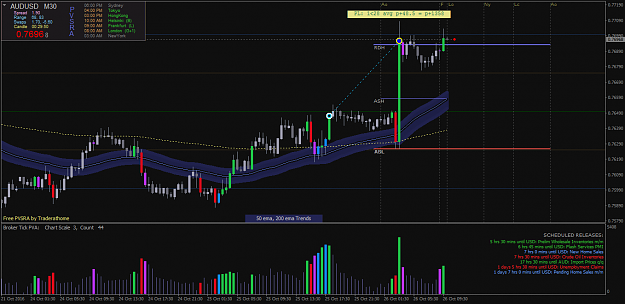

As you have noticed I am using Multi-TF Bias myself. Tah wanted to code it for M15 50EMA at first for easier heads up when scanning thru pairs. After some consultation he took serious my comments and the result is wonderful new indy. BUT, that is all it is - just another wonderful indy that is wonderfully lagging too.

So in the end- it is probably not sooooooooooooooo much better than simply stochastic would be, but the thing is that PVSRA reading once mastered has very high probability- just that I have many many times faced the problems with right direction, but timing not so right (too soon entry) so this results in DD at least, if not even in red trade.

Long story short- IMO PVSRA is the best possible TA tool you can ever have but needs to be mastered properly and also studyed properly . Howewer, expirience with trading PVSRA teaches the trader about HTMRW and this is equaly important if not even more important. So you need much time and patience here to learn really good and also gain enough expirience. The results can be amazing, but it is not at all easy to come to that point.

And- after you have done all of that- DISCIPLINE is playing a pretty big role too.

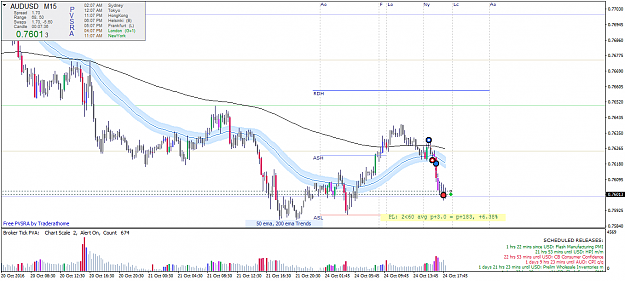

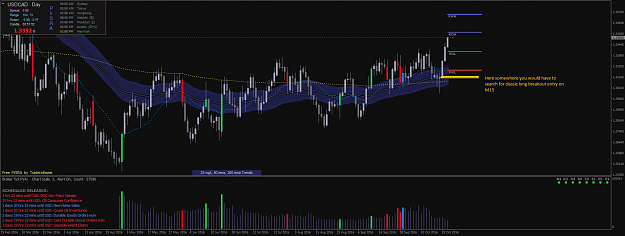

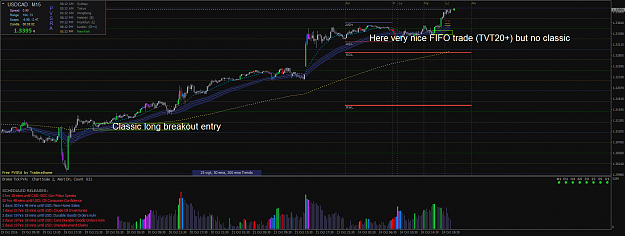

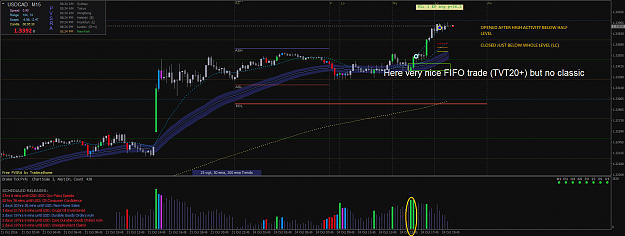

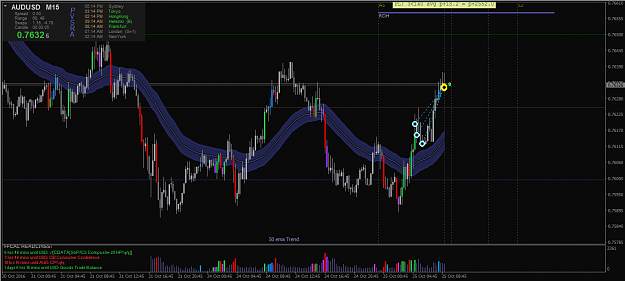

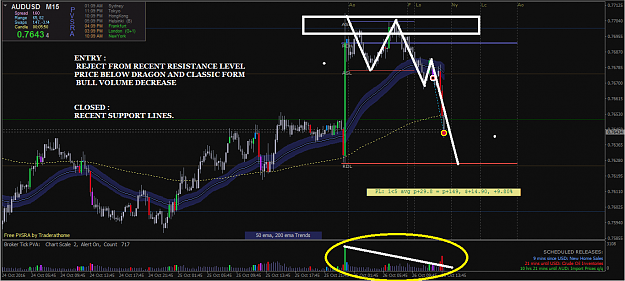

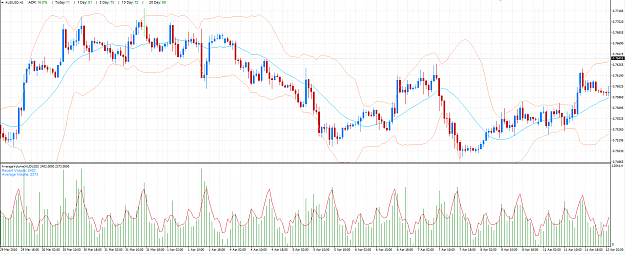

I am definitly not indys dependant trader, I like my charts as simple and as clean as possible, so I am scanning thru most of the pairs on the weekend without any bias or indy (Only PURE PVSRA TPL and some horizontal lines) - search for PVSRA clues and plan the trading weeek ahead- in sense that I leave most interesting charts open on my MT4 to observe further first few trading sessions of a new week.

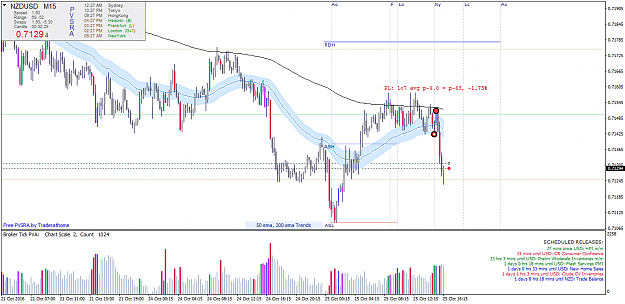

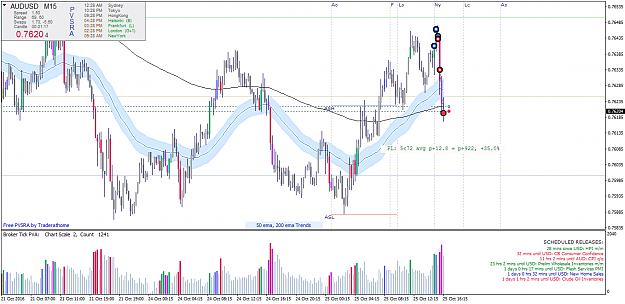

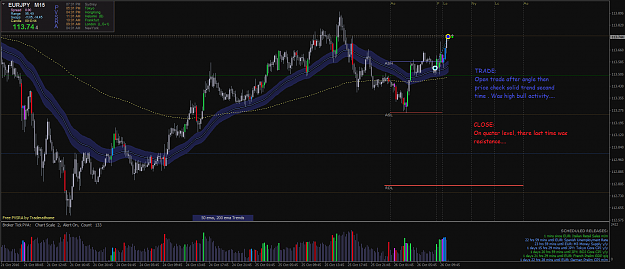

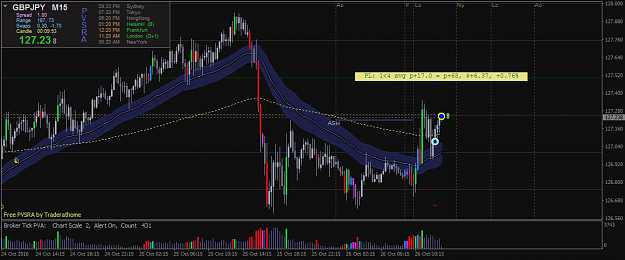

PVSRA

PVSRA+TLs M5-H1 Forward Test All Time Return:

36.1%