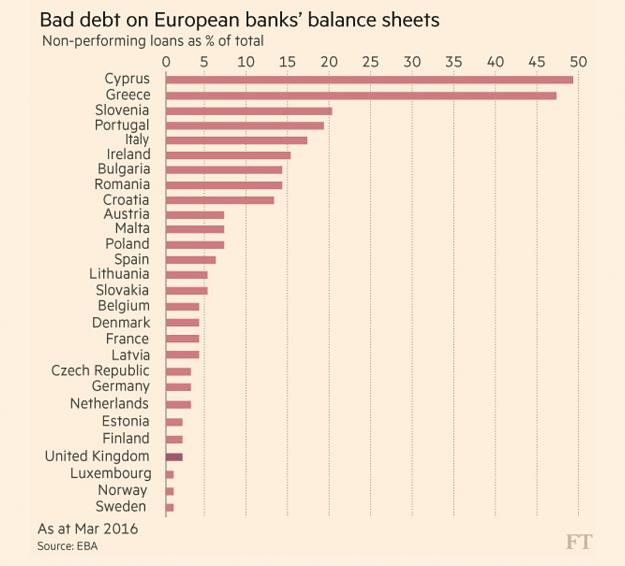

There are to come strains and challenges for the banking system across Europe. Some countries will be worse off than others. Part of the due dilligence before depositing money with a broker, is to consider the solidity of the banks they are using.

Regulation is more important than ever. Specifically look into the terms and amount covered by compensation schemes.

Below are results of ECB stress tests of banks:

Regulation is more important than ever. Specifically look into the terms and amount covered by compensation schemes.

Below are results of ECB stress tests of banks:

Do not let the cost of being wrong, exceed the prize of beeing right