Golden Levels: AUD/USD

This is thread is for posting golden level chart setups for AUD/USD only.

You can find out more about how to trade the method here:

>> Before posting charts: Learn More About Trading Forex Golden Levels

Why trade from golden S/R levels?

1. No need to predict. Predicting what the market will do consistently over time is, time taking, stressful and unnecessary.

2. Faster compounding by trading from the best price levels, with a high R:R (Risk:Reward ratio) and high win % rate.

3. Predictable income stream by closing trades for a reasonable R:R (not too low, not too high) and not relying on trends.

4. Less stress: Since our trading is centered around finding specific price levels to trade from, we wait for the market to come to us, not the other way around.

5. Less monitoring the market: Because we define price level to trade from ahead of time, we can use limit orders and/or price alerts.

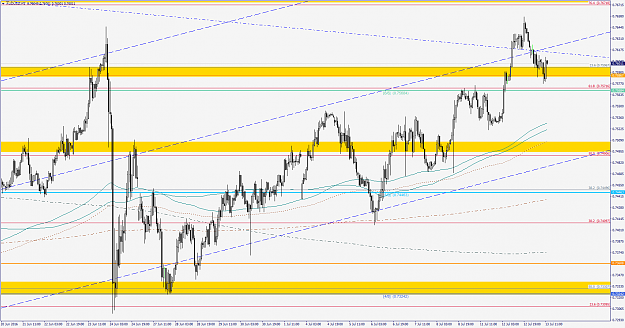

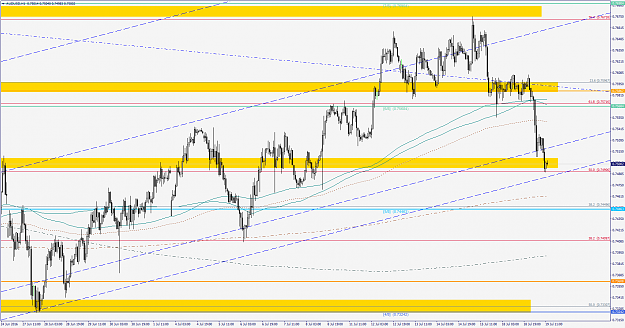

What are golden levels?

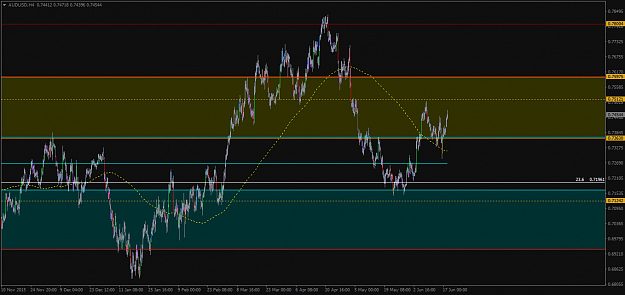

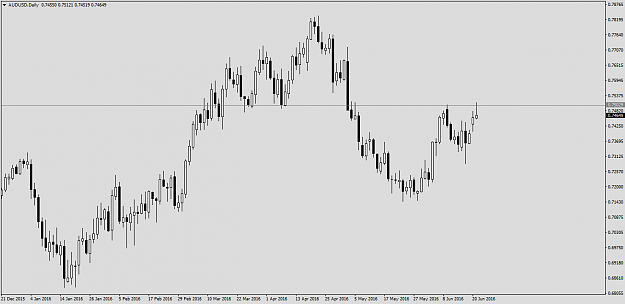

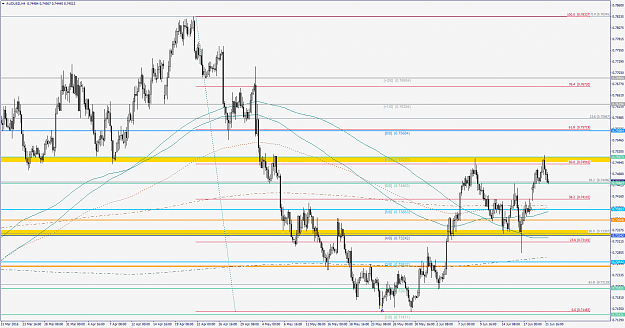

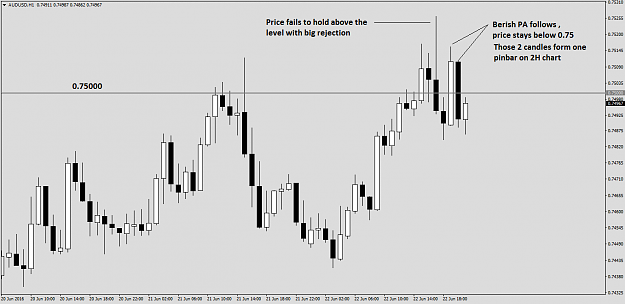

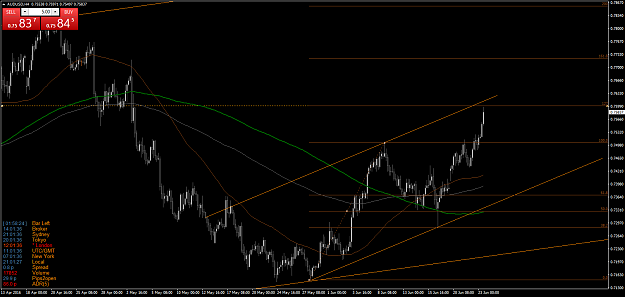

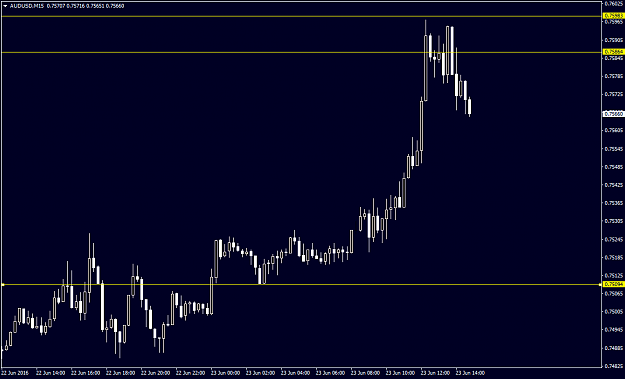

Golden levels are S/R (support/resistance) levels that are more reliable and better priced than most S/R levels. They are found deep within price ranges and are defined by many highs and lows on multiple time frames. An example:

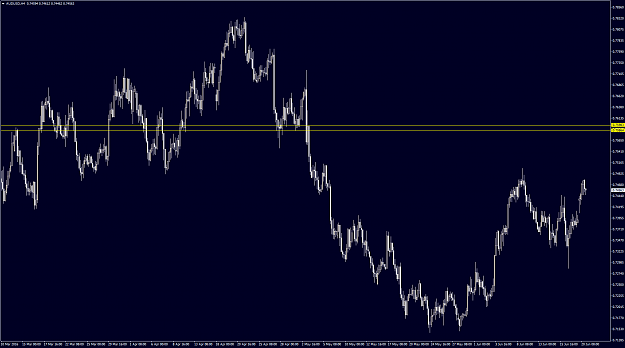

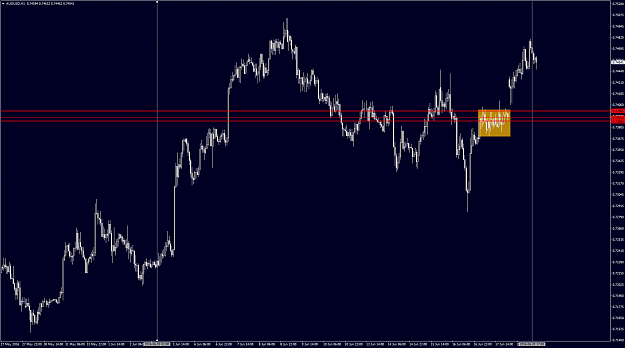

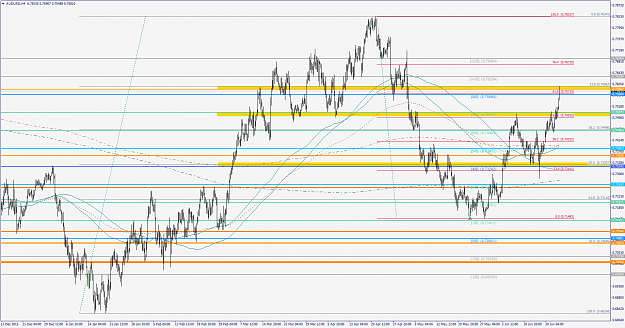

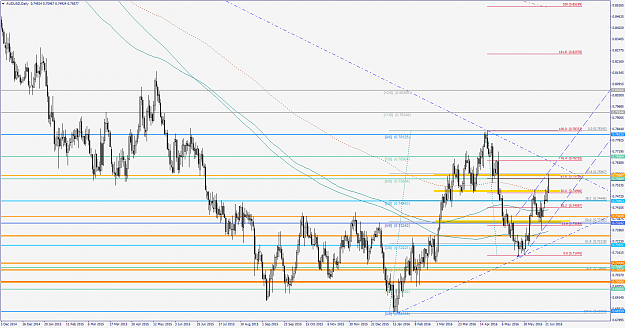

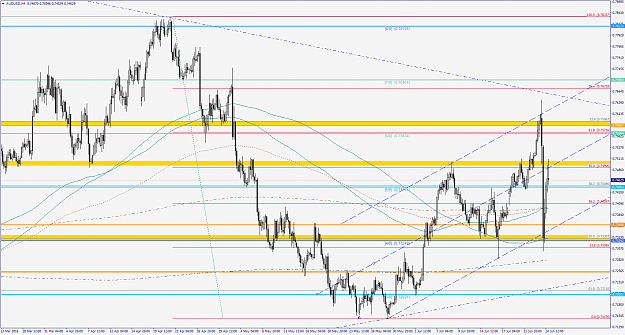

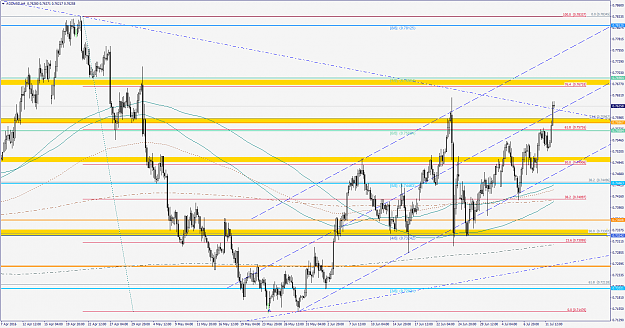

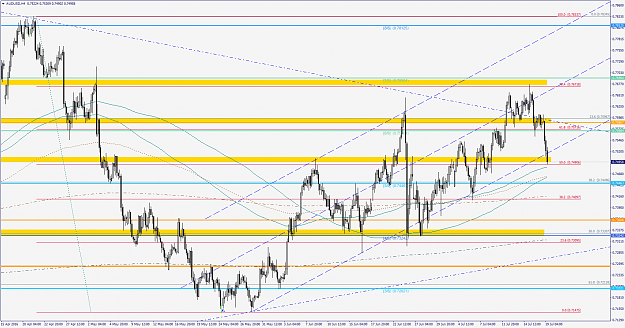

Another recent example in oil. Note how trading from the highs of the range would have resulted in a loss. Trading from levels that exist deeper in a range and are respected by price from the long and short side are stronger and result in more profit!

This is thread is for posting golden level chart setups for AUD/USD only.

You can find out more about how to trade the method here:

>> Before posting charts: Learn More About Trading Forex Golden Levels

Why trade from golden S/R levels?

1. No need to predict. Predicting what the market will do consistently over time is, time taking, stressful and unnecessary.

2. Faster compounding by trading from the best price levels, with a high R:R (Risk:Reward ratio) and high win % rate.

3. Predictable income stream by closing trades for a reasonable R:R (not too low, not too high) and not relying on trends.

4. Less stress: Since our trading is centered around finding specific price levels to trade from, we wait for the market to come to us, not the other way around.

5. Less monitoring the market: Because we define price level to trade from ahead of time, we can use limit orders and/or price alerts.

What are golden levels?

Golden levels are S/R (support/resistance) levels that are more reliable and better priced than most S/R levels. They are found deep within price ranges and are defined by many highs and lows on multiple time frames. An example:

Another recent example in oil. Note how trading from the highs of the range would have resulted in a loss. Trading from levels that exist deeper in a range and are respected by price from the long and short side are stronger and result in more profit!