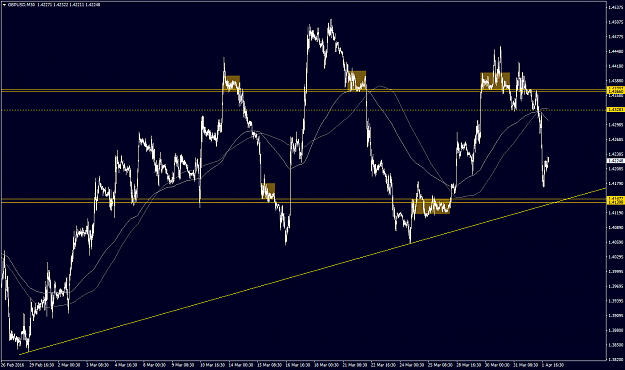

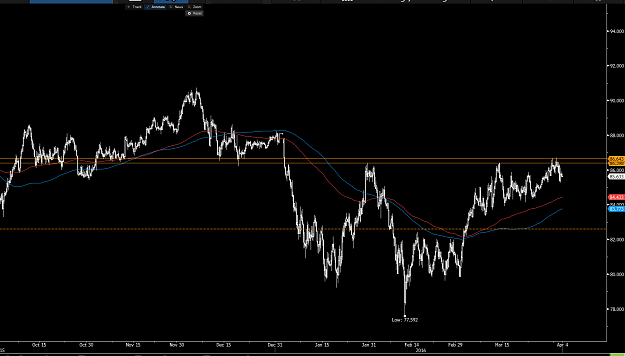

DislikedHello Quinton. Thanks for sharing, this is right up my alley. I just noticed this thread and am looking forward to learning and participating. I was well rewarded going long UCAD this past week based on what I believed to be a "golden" level. I banked some nice pips before Friday's news and was happy to rebuild a long position after Friday's strong post news pullback. Technical confirmation for me was a bit of divergence on the daily, and massively oversold on the 4H. In addition, it lined up well with what I call my purple "planar" lines. Fundamentally,...Ignored

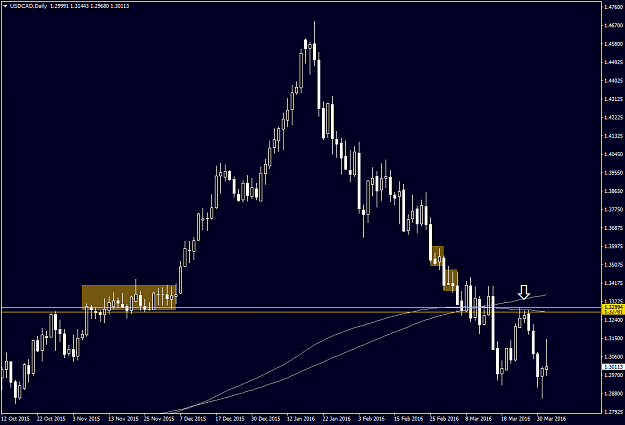

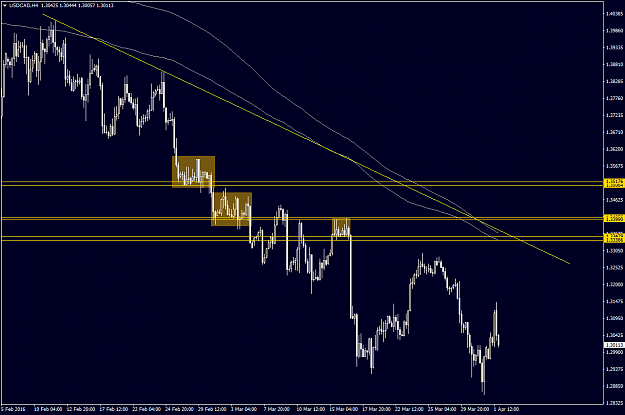

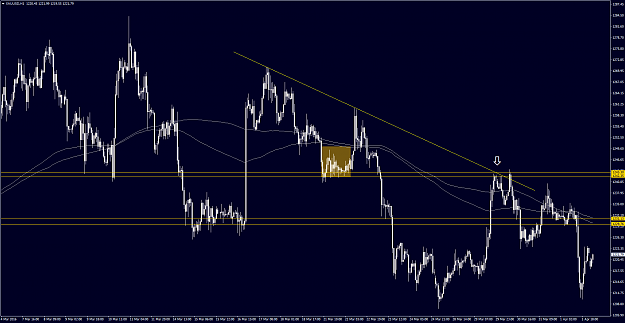

USD/CAD

You guys love those long-term charts.

I was eying the same area but set my levels a bit some conservatively and therefore did not enter the market.

This was before the thread was created, but I took a short at the golden level below with daily 200 MA resistance. When these factors line up they are literally golden!

There is enough indecision in this market that the level @ 1.3300 could get retested from the short-side and end up defining at least a short-term range. The H4 200 MAs are looking like there are going to rush in to provide some additional resistance to that level. It depends on how PA acts on the sub-H1 charts.

More conservative candidates for a short to be found a bit higher up. There are three that I dug up: The lower one @ 1.3336 has a TL and possible H4 200 MAs lining up. The other two are essentially the round levels 1.3400 and 1.3500.

Many times confluence factors can help you decide between various golden levels, but the situation on USD/CAD is a bit ambiguous right now since the other levels without confluence are priced so much better. Short-term PA will have to decide this one.

Q