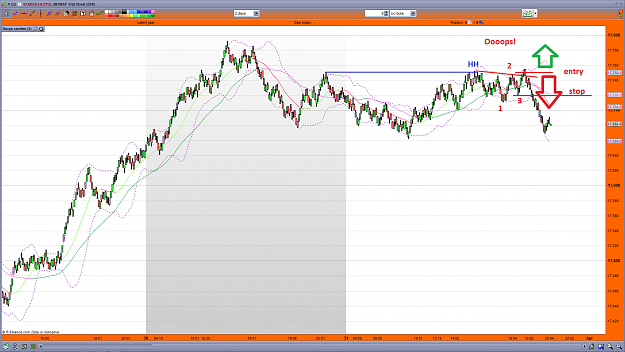

Wow, two bad trades last night to finish and two more early this morning. Difficult to overcome for the moment. I'm not sure if it is because of my having the lurgy, but my discipline has all gone to f*ck right now!

Just shows how easy it is to go off track in this game. Simple stupid mistakes as well. Deviating from the norm slightly and taking riskier trades, plus bringing stops down too quickly. I need to practice what i preach;

'The fear of losing money, costs you more in the long run...'

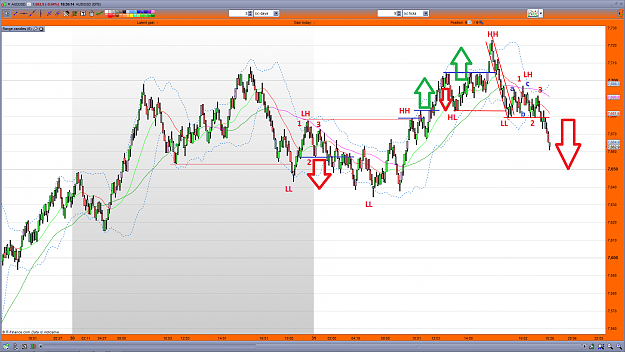

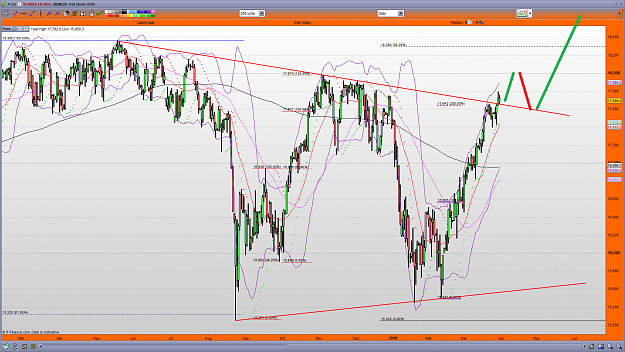

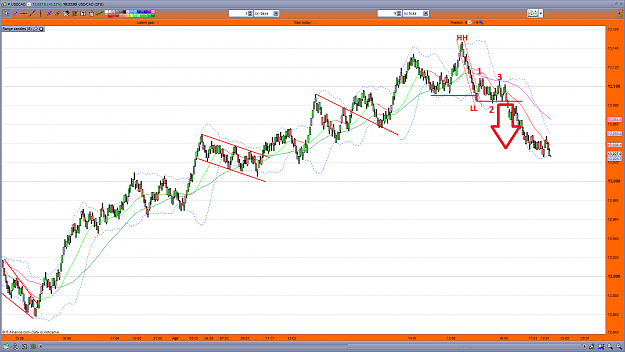

Trying to hold out for the bigger move short on the UsdCad, ignoring nearly 30 pips of profit and bringing stoploss down to BE. That is the very point the market will retrace to in the event of a pullback. It will either cross slightly if we are playing out a diagonal, or it will use it as Support now turned Resistance. How come, knowing this full well, i still did so???

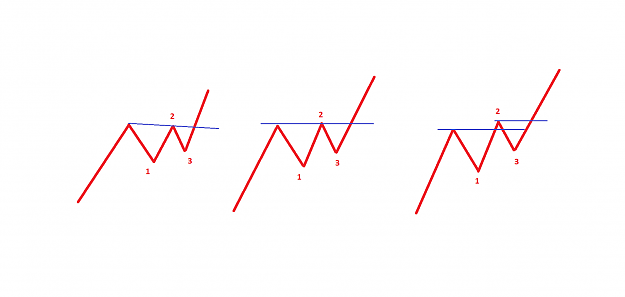

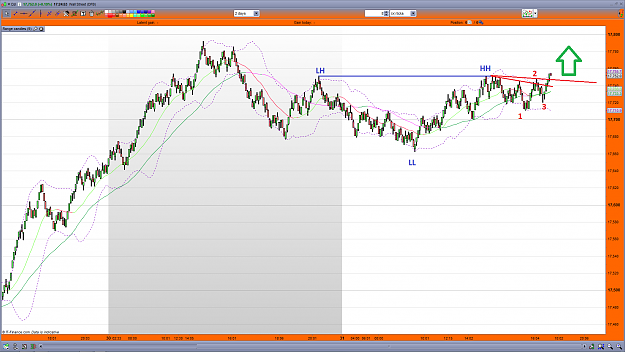

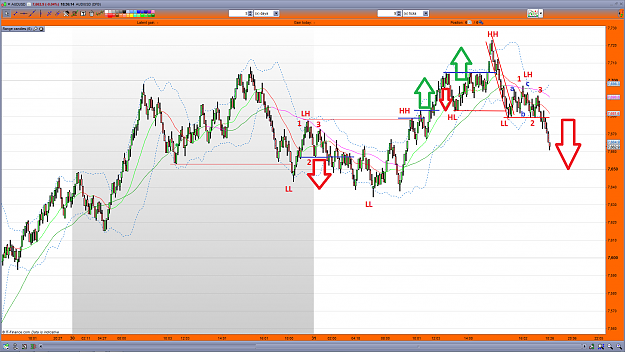

Reason for taking 123 after deep pullback; still in downtrend imo, as the last sig LH not breached. A 123 setting up near to the breach but back to original trend is common...

This was a typical 'double bite' trade that i mentioned yesterday. The 25 pips on offer should have been bagged and then re-entry (this time for free) at the retest, for the bigger bite. Instead, stopped out for BE. Ok, you have to weigh up trading for the double bite vs the let it run attitude. My mistake was merely moving stop to BE too early.

Poor... very poor - literally!

Just shows how easy it is to go off track in this game. Simple stupid mistakes as well. Deviating from the norm slightly and taking riskier trades, plus bringing stops down too quickly. I need to practice what i preach;

'The fear of losing money, costs you more in the long run...'

Trying to hold out for the bigger move short on the UsdCad, ignoring nearly 30 pips of profit and bringing stoploss down to BE. That is the very point the market will retrace to in the event of a pullback. It will either cross slightly if we are playing out a diagonal, or it will use it as Support now turned Resistance. How come, knowing this full well, i still did so???

Reason for taking 123 after deep pullback; still in downtrend imo, as the last sig LH not breached. A 123 setting up near to the breach but back to original trend is common...

This was a typical 'double bite' trade that i mentioned yesterday. The 25 pips on offer should have been bagged and then re-entry (this time for free) at the retest, for the bigger bite. Instead, stopped out for BE. Ok, you have to weigh up trading for the double bite vs the let it run attitude. My mistake was merely moving stop to BE too early.

Poor... very poor - literally!

GoFundMe -stage-4-glioma-brain-cancer-fighter (link in my profile)