Disliked{quote} Yes, I see everthing is importance. Maybe I read and forget , or I missed them. In fact, I have a little difficult to understand because of my English. So I am very thank you If someone remind me about MA5 and MA20. Maybe, they are breakout but I don't see them in our trading plan and entry.Ignored

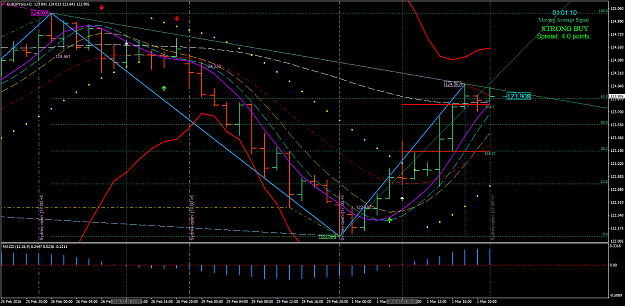

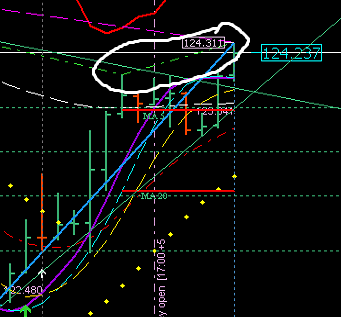

"When a trader uses an ADR indicator (Average Day Range) it also has what is known as the ADN (Average Day Noise) which most traders have no knowledge of. On the Paradox this average day noise is displayed at the very beginning of the 17:00 EST Daily candle. This is one reason you reboot your platform after 17:00: If you reboot then; and reboot again on closing your platform - then the ADN has changed position from the previous data.

The Average Day Noise is consider the noise of the traders trying to position for a trade with the opening Daily Candle. And the ADN indicator lines never moves but remain as they are from bar to bar (accept squeezing towards one another) as the market is moving.

So the MA is the ADN of the ADR. In between those lines is Weak Sales or Weak Buys depending on trend at opening. Strong buys are above the MA 20 and Strong sales are below the MA 5. That is what the MA means and what it is for." The Dove - Forex Trainer