I have been trading this the last few weeks as I was looking for a strategy I could trade everyday around the same time to avoid overtrading. I have seen this strategy posted back in 2008.

I'm looking to revive this strategy on this forum as it can be very profitable riding the trend of the day in these major financial city's Tokyo/London and Newyork

When the big dog traders sit down to trade around 9am of there opening you see a huge change in volatility as i'm sure your aware off if you have ever traded these times.

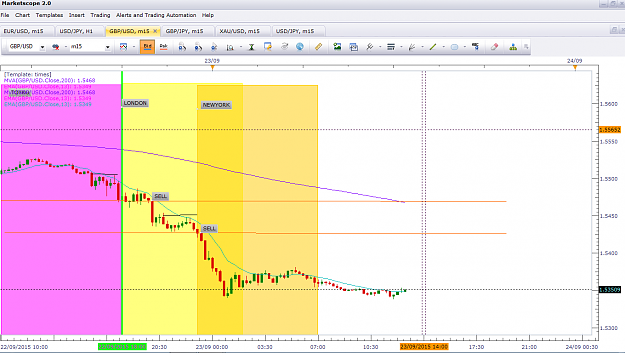

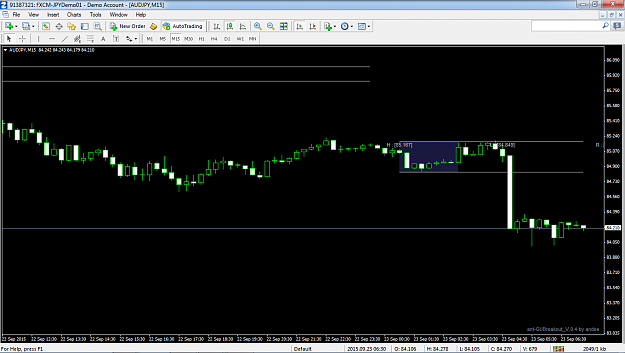

I take the last 8 hours on the 15 min chart and draw the highs and lows of the Tokyo session and once the price breaks these this is my entry.

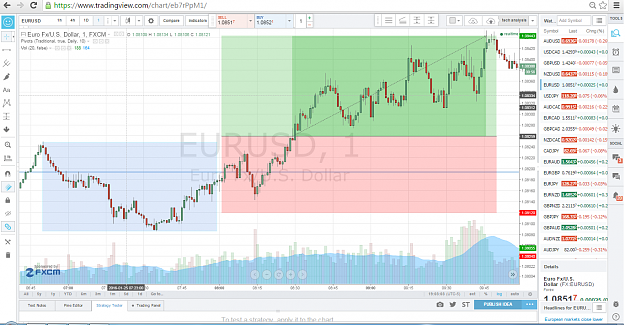

I use (GBP/USD EUR/USD) for LONDON AND NY OPEN AND USD/JPY FOR TOKYO SESSION

I'm happy to improve the rules and fundamentals to make this strategy more predictable so any idea's or improvements please feel free to post

Thats enough talking, here is a screen shot of the London and NY open yesterday, as you can see there was a strong trend down occurring on both opens

I like to take a first profit at 30 pips and then I use a trailing stop of 15pips on my second order

You get a perfect trade about 50% of the time others need some babysitting and cut your losses short

I attached an indicator i found, just change the times to what session you want to to trade eg 00:00 - 08:00 Gmt London session

Hopefully the guys that made this are now Millionaires and no longer come on trading forums haha

I'm looking to revive this strategy on this forum as it can be very profitable riding the trend of the day in these major financial city's Tokyo/London and Newyork

When the big dog traders sit down to trade around 9am of there opening you see a huge change in volatility as i'm sure your aware off if you have ever traded these times.

I take the last 8 hours on the 15 min chart and draw the highs and lows of the Tokyo session and once the price breaks these this is my entry.

I use (GBP/USD EUR/USD) for LONDON AND NY OPEN AND USD/JPY FOR TOKYO SESSION

I'm happy to improve the rules and fundamentals to make this strategy more predictable so any idea's or improvements please feel free to post

Thats enough talking, here is a screen shot of the London and NY open yesterday, as you can see there was a strong trend down occurring on both opens

I like to take a first profit at 30 pips and then I use a trailing stop of 15pips on my second order

You get a perfect trade about 50% of the time others need some babysitting and cut your losses short

I attached an indicator i found, just change the times to what session you want to to trade eg 00:00 - 08:00 Gmt London session

Hopefully the guys that made this are now Millionaires and no longer come on trading forums haha

Attached File(s)