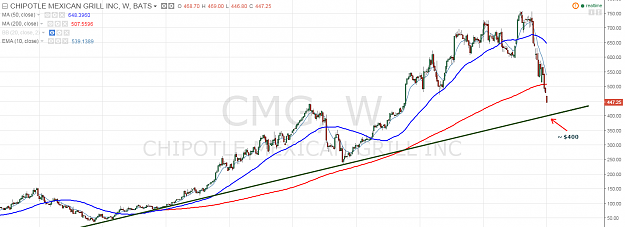

Today it would be better to manualy close NOW for $2.50 (because it is bouncing from support), but I am satisfied. I didn't expect such a sell-of today, I was thinking of a red day today, but less than a percent down... (addon - expectation from Dec 31, BEFORE the Chinese plunged...)

Hope is dangerous in this game.