I've been a long time member here, but I have not been too active in past few yrs due to busy schedule with work(I work in finance). I've been toying with many systems over the past two yrs, really trying to find a system that fits my personality and work well with my active lifestyle. The end results that have been produced in terms of a systematic approach has been a swing trading methodology off of a trading model on the daily chart.

Position Sizing- I have a simple excel model that I use to "score" the outputs of each of the model components, which gives me a probability approach when it comes to position sizing. In terms of position sizing, I usually do not go too big, meaning that anywhere above 5:1 leverage would be aggressive. This allows me to get rid of the use of stops, which in my professional experience do not do me any good. There are many different thoughts on this, and I really believe that it all comes down to how much pain you are willing to take in a trade and your level of mental discipline. My position sizing is usually small(unless I am very confident on a trade, then I throw everything I have at it) so this lets me be completely indifferent as to whether I was +200p or -200p. I think Larry Hite said something similar-use sizing to where you are completely indifferent on a trade.

Holding- In terms of holding time, I will hold a trade as long as it's paying me.

Execution- In terms of execution, I don't do anything fancy, I simply place limit orders at levels where price has bounced off sharply, indicative of good size liquidity. From my experience, bigger orders are usually around big figures. It is very important to be patient, I will wait as long as necessary for a trade to be presented.

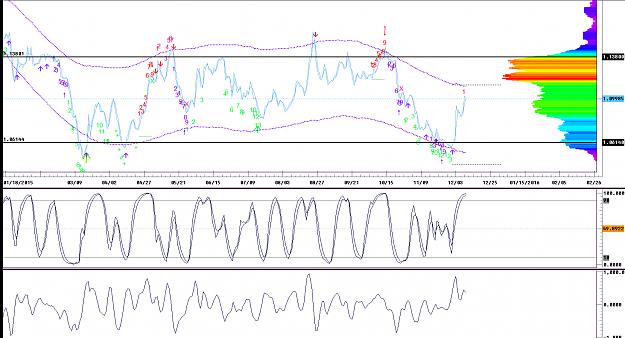

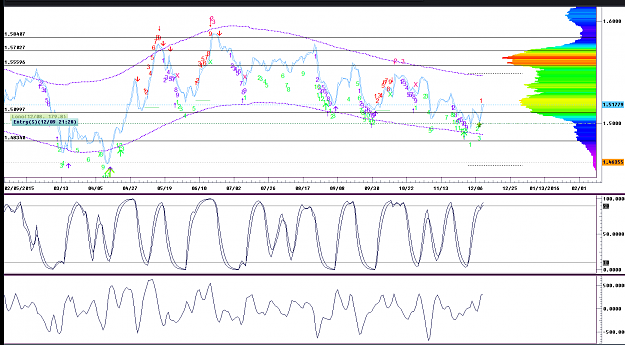

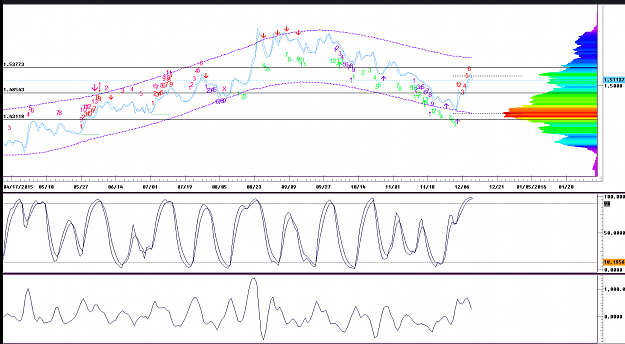

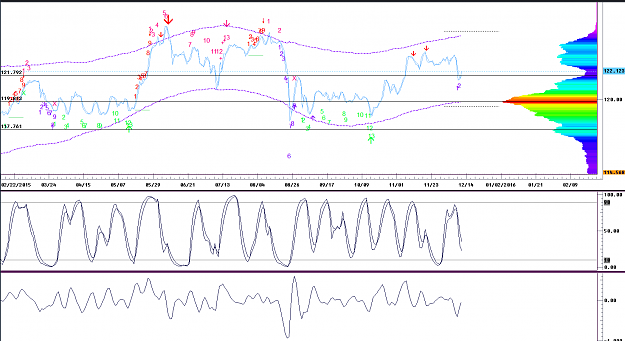

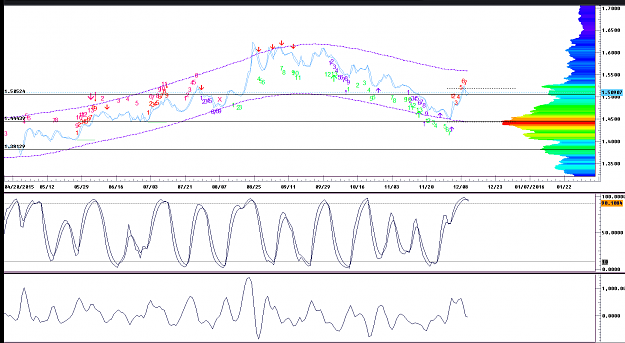

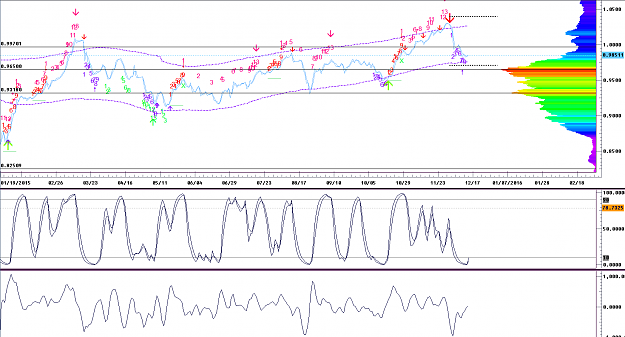

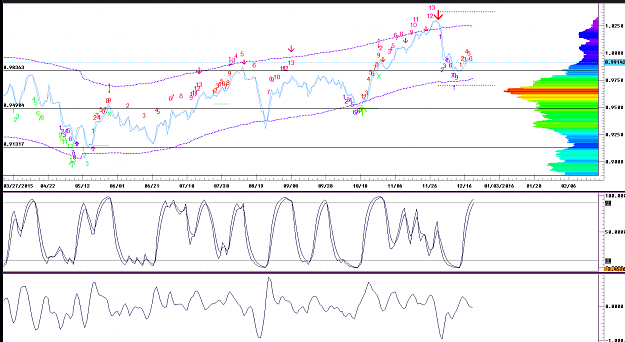

The system-I use a time series forecasting indicator, a stochastic with a proprietary smoothing algorithm, composite market profile(with proprietary levels of S&R), monthly range projection, two timing indicators(DeMark and proprietary)

I really just want to see other people discuss systematic approaches to swing/position trading off the daily charts-so please no intraday here

Position Sizing- I have a simple excel model that I use to "score" the outputs of each of the model components, which gives me a probability approach when it comes to position sizing. In terms of position sizing, I usually do not go too big, meaning that anywhere above 5:1 leverage would be aggressive. This allows me to get rid of the use of stops, which in my professional experience do not do me any good. There are many different thoughts on this, and I really believe that it all comes down to how much pain you are willing to take in a trade and your level of mental discipline. My position sizing is usually small(unless I am very confident on a trade, then I throw everything I have at it) so this lets me be completely indifferent as to whether I was +200p or -200p. I think Larry Hite said something similar-use sizing to where you are completely indifferent on a trade.

Holding- In terms of holding time, I will hold a trade as long as it's paying me.

Execution- In terms of execution, I don't do anything fancy, I simply place limit orders at levels where price has bounced off sharply, indicative of good size liquidity. From my experience, bigger orders are usually around big figures. It is very important to be patient, I will wait as long as necessary for a trade to be presented.

The system-I use a time series forecasting indicator, a stochastic with a proprietary smoothing algorithm, composite market profile(with proprietary levels of S&R), monthly range projection, two timing indicators(DeMark and proprietary)

I really just want to see other people discuss systematic approaches to swing/position trading off the daily charts-so please no intraday here