DislikedJust saying that I am interested in this thread and all its ramblings, but until someone steps up with some kind of scientific basis with statistics and empirical evidence, I am kinda afraid a lot of it would get almost nowhere.... Or maybe its just me.Ignored

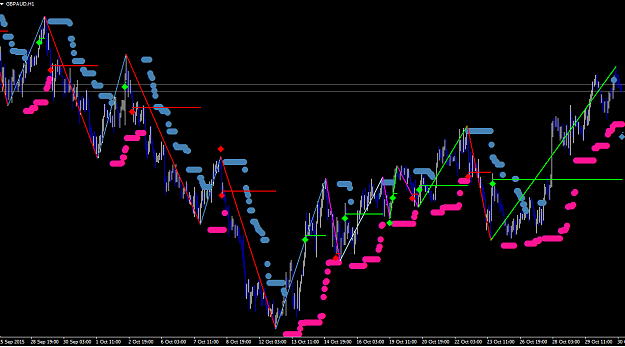

I almost made 200% gain in 4months of trading.Was it all accidental?Don't think so.Yes mostly on fib pivots.

Goes without saying profitable trader does not sell or buy automatically even on key areas.One must wait for weakness either direction.Staying clear of major events and so on.Yes there is great deal of subjective discretion but I believe in Fibs and my profits are my evidence

I am sure Lots of expensive robots are programmed to trade profitable and that in itself means market is measurable.I am sure most of trading now is by alglos and very little human involvement.Since its designed by humans still it reacts to fibs,round numbers etc.

In trading, you have to be defensive and aggressive at the same time