Hi All,

Welcome to the Traders Corner Forex Strategies thread.

My brother and I run TradersCorner-Online.com website dedicated to educating Forex traders.

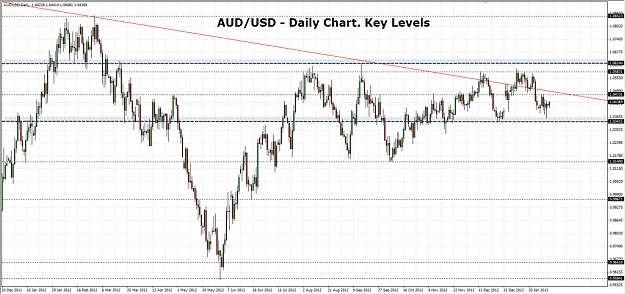

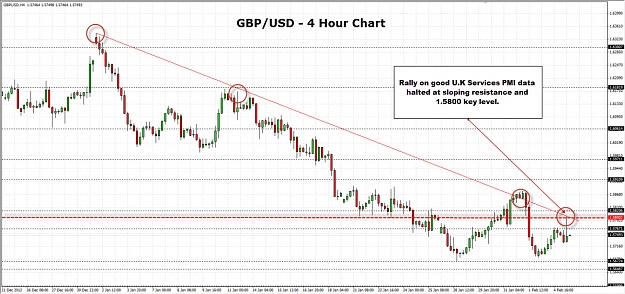

In this thread you are going to find our analysis of the markets, market commentary, video tutorials and of course charts that help to illustrate the way we go about profiting from the Forex markets.

Now please be warned this is a thread for serious traders so if you are interested in a get rich quick scheme then this is not for you. We would love to be able to say we win every trade and can teach you to do the same but unfortunately we trade in the real world where this is simply not possible.

Having said that, it is very possible to make money in the markets and if you want to learn how then stick around as we can show you how.

Please feel free to participate and ask questions.

Best Regards

Alex Ong

Traders Corner

Welcome to the Traders Corner Forex Strategies thread.

My brother and I run TradersCorner-Online.com website dedicated to educating Forex traders.

In this thread you are going to find our analysis of the markets, market commentary, video tutorials and of course charts that help to illustrate the way we go about profiting from the Forex markets.

Now please be warned this is a thread for serious traders so if you are interested in a get rich quick scheme then this is not for you. We would love to be able to say we win every trade and can teach you to do the same but unfortunately we trade in the real world where this is simply not possible.

Having said that, it is very possible to make money in the markets and if you want to learn how then stick around as we can show you how.

Please feel free to participate and ask questions.

Best Regards

Alex Ong

Traders Corner

Check out my profile for my social media links