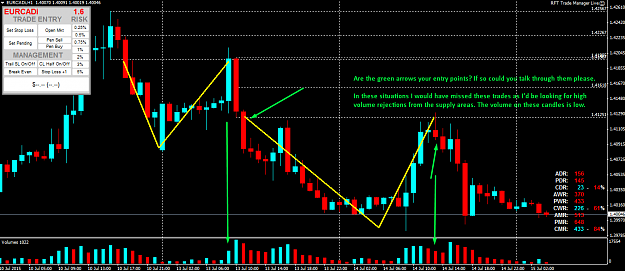

Disliked{quote} Personally I took a 15min chart long at 1.3090. Off 1 hr zone high from yesterday / high of 15 min zone today. Confluence anyone! {image}Ignored

- Post #27,003

- Quote

- Aug 20, 2015 12:40pm Aug 20, 2015 12:40pm

- Joined Sep 2010 | Status: I'm not here... or am I? | 3,999 Posts

Today's zone = Tomorrow's opportunity!

- Post #27,005

- Quote

- Aug 20, 2015 5:01pm Aug 20, 2015 5:01pm

"Never Take a Trade You Don't Understand!" - Pres78

- Post #27,006

- Quote

- Aug 20, 2015 6:50pm Aug 20, 2015 6:50pm

- Joined Sep 2010 | Status: I'm not here... or am I? | 3,999 Posts

Today's zone = Tomorrow's opportunity!

- Post #27,007

- Quote

- Edited 4:39am Aug 21, 2015 4:19am | Edited 4:39am

"Never Take a Trade You Don't Understand!" - Pres78

- Post #27,008

- Quote

- Aug 21, 2015 11:34am Aug 21, 2015 11:34am

- Joined Aug 2009 | Status: Reading the TAPE | 2,334 Posts

Wyckoff VSA: (1) Supply & Demand (2) Effort vs. Result (3) Cause & Effect

- Post #27,009

- Quote

- Aug 21, 2015 12:23pm Aug 21, 2015 12:23pm

- Joined Sep 2010 | Status: I'm not here... or am I? | 3,999 Posts

Today's zone = Tomorrow's opportunity!

- Post #27,010

- Quote

- Aug 21, 2015 12:50pm Aug 21, 2015 12:50pm

"Never Take a Trade You Don't Understand!" - Pres78

- Post #27,011

- Quote

- Edited 4:51pm Aug 21, 2015 4:02pm | Edited 4:51pm

- | Joined Apr 2015 | Status: Member | 542 Posts

- Post #27,013

- Quote

- Aug 21, 2015 9:16pm Aug 21, 2015 9:16pm

- Joined Aug 2009 | Status: Reading the TAPE | 2,334 Posts

Wyckoff VSA: (1) Supply & Demand (2) Effort vs. Result (3) Cause & Effect

- Post #27,014

- Quote

- Aug 24, 2015 11:42am Aug 24, 2015 11:42am

- | Joined Jan 2009 | Status: Fading the specs | 1,374 Posts

- Post #27,015

- Quote

- Aug 24, 2015 12:11pm Aug 24, 2015 12:11pm

- Joined Sep 2010 | Status: I'm not here... or am I? | 3,999 Posts

Today's zone = Tomorrow's opportunity!

- Post #27,016

- Quote

- Aug 25, 2015 10:51am Aug 25, 2015 10:51am

- | Joined Mar 2007 | Status: Member | 418 Posts

- Post #27,017

- Quote

- Aug 25, 2015 11:49am Aug 25, 2015 11:49am

The loss was not bad luck. It was bad Analysis - D.Einhorn

- Post #27,018

- Quote

- Aug 25, 2015 11:56am Aug 25, 2015 11:56am

The loss was not bad luck. It was bad Analysis - D.Einhorn

- Post #27,019

- Quote

- Aug 25, 2015 12:08pm Aug 25, 2015 12:08pm

- Joined Sep 2010 | Status: I'm not here... or am I? | 3,999 Posts

Today's zone = Tomorrow's opportunity!

- Post #27,020

- Quote

- Aug 25, 2015 12:24pm Aug 25, 2015 12:24pm

The loss was not bad luck. It was bad Analysis - D.Einhorn