90% of traders do not know what is Market Maker and how trades are done. Also, 90% of traders get too emotional when they trade and this influences their trades. The stuff with emotions actually is the same for poker players.

- Joined Mar 2012 | Status: Trader | 12,127 Posts

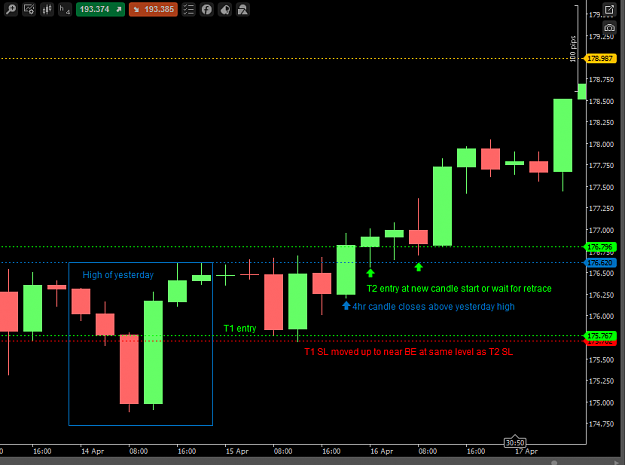

My Threads: Trading is as simple as 1-2-3, Highest Open / Lowest Open Trade