If you study Market Profile, Auction Market Theory, Supply & Demand, Volume Spread Analysis, Order Flow, or a few other market methods/paradigms/indicators, you will conclude that price is not completely random. And if it is not completely random than it is somewhat predictable. But if you want to move to the head of the class, you will become one with the following statement:

While predicting price may be possible to some degree; to be a successful trader, predicting price is certainly not necessary.

While predicting price may be possible to some degree; to be a successful trader, predicting price is certainly not necessary.

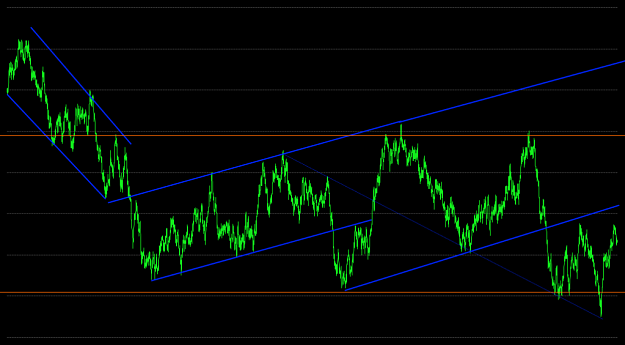

Wyckoff VSA: (1) Supply & Demand (2) Effort vs. Result (3) Cause & Effect