Disliked{quote} This post possibly represents the #1 reason why many no longer contribute to this thread. If you want a "hot tip" as Jim Rogers would say or a trade mirror service there are plenty out there. I am a full time trader, have been for almost 10 years and I can confidently tell you that you will never make money in this market. You want the best trade call you will ever see on this forum? Trade your current attitude and investment choice from where it's currently at and stop trading FX. That will save you time, money and may make you more friends....Ignored

Is it wrong to show live setups, and if so, why?

Yeah, I remember when you did try to make live setup calls.

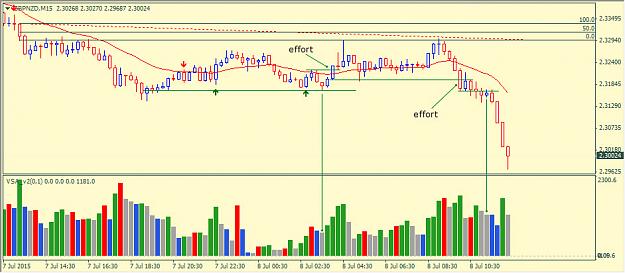

I am not judging anyone here, but I honestly believe, that you could not learn to trade from old charts, it`s a live setups and analysis after that what went wrong, if not successful.

.

"This is not a signal service" lol, that is old excuse to that people cannot give live setups, other excuse is that " I trade 3 minutes charts"...so, if someone is trading from 3 minutes charts, I am pretty sure that he or she would first look for example H 1 chart.

But like I said, you do not have to post any charts if you don`t want, but signals are there in both charts, old and live.

And posting them, could save money and make faster learning curve, so it is only win-win situation, and people are mad about that?

Anyways, happy trading.