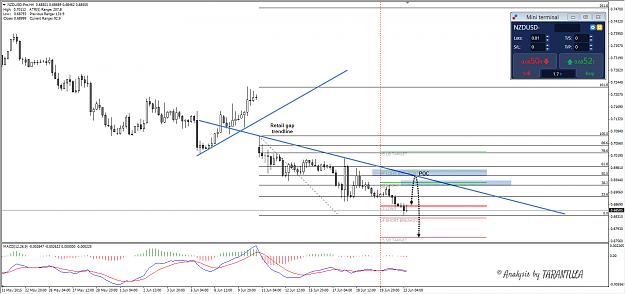

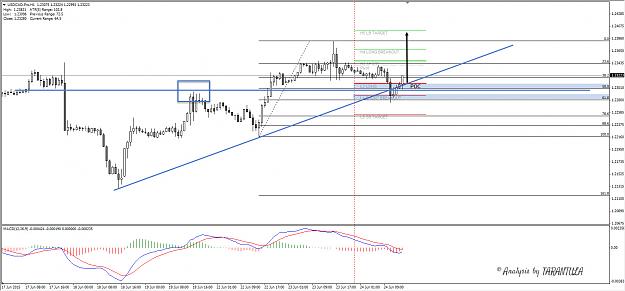

And the target on NZDUSD has been hit. ALso, stay away from EURUSD at the moment. Yesterday there were some nasty spikes. I think we could see those spikes until the situation is resolved.

- Post #21,561

- Quote

- Jun 19, 2015 3:11am Jun 19, 2015 3:11am

- | Commercial Member | Joined Feb 2010 | 14,361 Posts

- Post #21,562

- Quote

- Jun 19, 2015 8:43am Jun 19, 2015 8:43am

- | Commercial Member | Joined Feb 2010 | 14,361 Posts

- Post #21,563

- Quote

- Jun 22, 2015 8:21am Jun 22, 2015 8:21am

- | Commercial Member | Joined Feb 2010 | 14,361 Posts

- Post #21,564

- Quote

- Jun 23, 2015 3:19am Jun 23, 2015 3:19am

- | Commercial Member | Joined Feb 2010 | 14,361 Posts

- Post #21,565

- Quote

- Jun 23, 2015 4:49am Jun 23, 2015 4:49am

- | Commercial Member | Joined Feb 2010 | 14,361 Posts

- Post #21,567

- Quote

- Jun 23, 2015 9:49am Jun 23, 2015 9:49am

- | Commercial Member | Joined Feb 2010 | 14,361 Posts

- Post #21,568

- Quote

- Edited 4:05am Jun 24, 2015 3:53am | Edited 4:05am

- | Commercial Member | Joined Feb 2010 | 14,361 Posts

- Post #21,569

- Quote

- Jun 24, 2015 9:01am Jun 24, 2015 9:01am

- | Commercial Member | Joined Feb 2010 | 14,361 Posts

- Post #21,570

- Quote

- Jun 24, 2015 9:24am Jun 24, 2015 9:24am

- | Commercial Member | Joined Feb 2010 | 14,361 Posts

- Post #21,571

- Quote

- Jun 25, 2015 3:39am Jun 25, 2015 3:39am

- | Commercial Member | Joined Feb 2010 | 14,361 Posts

- Post #21,572

- Quote

- Jun 25, 2015 4:52am Jun 25, 2015 4:52am

- | Commercial Member | Joined Feb 2010 | 14,361 Posts

- Post #21,573

- Quote

- Jun 26, 2015 3:44am Jun 26, 2015 3:44am

- | Commercial Member | Joined Feb 2010 | 14,361 Posts

- Post #21,574

- Quote

- Jun 26, 2015 5:45am Jun 26, 2015 5:45am

- | Commercial Member | Joined Feb 2010 | 14,361 Posts

- Post #21,575

- Quote

- Jun 28, 2015 6:16pm Jun 28, 2015 6:16pm

- | Commercial Member | Joined Feb 2010 | 14,361 Posts

- Post #21,576

- Quote

- Jun 28, 2015 6:43pm Jun 28, 2015 6:43pm

Scalping

small stop loss ; ) All Time Return:

53.3%

- Post #21,577

- Quote

- Jun 29, 2015 3:02am Jun 29, 2015 3:02am

- | Commercial Member | Joined Feb 2010 | 14,361 Posts

- Post #21,578

- Quote

- Jun 29, 2015 3:57am Jun 29, 2015 3:57am

- | Commercial Member | Joined Feb 2010 | 14,361 Posts

- Post #21,579

- Quote

- Jun 29, 2015 8:44am Jun 29, 2015 8:44am

- | Commercial Member | Joined Feb 2010 | 14,361 Posts

- Post #21,580

- Quote

- Jun 29, 2015 10:39am Jun 29, 2015 10:39am

- | Commercial Member | Joined Feb 2010 | 14,361 Posts