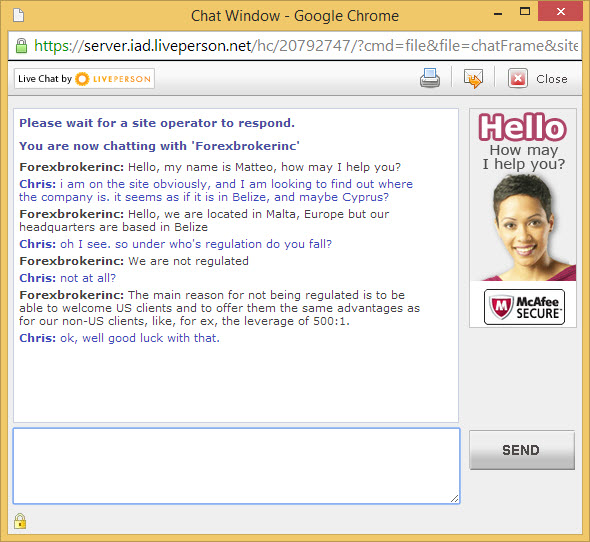

Wow, just wow.....I didn't even know this was possible. lol

Attached Image

Silent room 2 replies

Silent Success of Patience 10 replies

My silent journal 4 replies

bo7a method... method for GBP/JPY 205 replies

Seeing Through the Silent Crash 4 replies

DislikedHello Chris, i have been following your thread for years. This is a belated post, but better late than never. Your thread taught me a lot about trading. You have built a legend here. Thanks. God bless youIgnored

DislikedIntroduction: ...Stupid answers like "I wanna get rich, man" are spoken by people I call liquidity.Ignored

Disliked{quote} Thank you dino...... Still trading away, and working as a technical analyst for several companies. Funny how things happen......never really thought that Forex would become my career. ChrisIgnored

DislikedFor what it is worth, I believe we are within a couple of weeks of seeing the bottom of EUR/USD.... Happy trading this year! ChrisIgnored

DislikedBeen forever, the work never stops I guess. (I am currently doing something like 28 videos a day on average, mainly analysis.) Any way - here is a favorite of mine at the moment: The Nikkei 225..... Check out this weekly chart, with the 6 month, 12 month, and 24 month EMA's. We just broke over the 20,000 yen level, and I think we are breaking out towards the 25,000 yen level eventually. The Bank of Japan will almost undoubtedly add liquidity to the markets, and this will move money from bonds into the stock markets. (Although who in the hell is...Ignored

DislikedThanks mate... As you can see, we are still hanging about and over the 25000 level. I think that the Nikkei is a decent way to go in the global stock markets simply because it is "somewhat" insulated from Europe. In other words, if Paris loses 3% tomorrow, Tokyo might only lose 1%. That's the theory anyway. I am now interested in gold for a short-term trade higher. {image}Ignored

DislikedWatching 10 year notes. Seems demand is dropping for US bonds. This can lead to a lack of demand for the Dollar. This can translate into the Forex markets as well.... Looking at the Forex markets, I think we are about to see a corresponding move in the US Dollar to the ten year. I see a drop to the support line in the bond market, and a similar move in at least three markets: The USD/CAD, EUR/USD, and GBP/USD. Of course, anything can happen, but this is the best we can do: play the best percentages... 10 year: {image} USD/CAD: {image} EUR/USD: {image}...Ignored

DislikedFirst of all Clockwork I have to thank you for this amaizing thread and the fact that you are still here makes it even better! I think i talk on the name of everyone here hahaSince i am just on the page 65 of this thread.. I would like to ask if anything changed from the way you used to trade compared to the way to trade now. I mean.. looking for weekly S/R.. from there look for Pinbars, outside bars.. price action on Daily and H4 to determine an entry. Of course I will still read it all. Thanks

Ignored