Not sure if anyone is interested in this or not, but the way I see it, if a name like JPM admits to blatant fraud, no broker should be considered 'trusted'.

Is it just me, or has there been an above-average incidence/clustering of "big names" being "exposed" for "misconduct" lately (Hollywood/News icons/Gov't/Banks). Guess I'm a bit of a conspiracy theorist.

Anyway this was published 2 days ago:

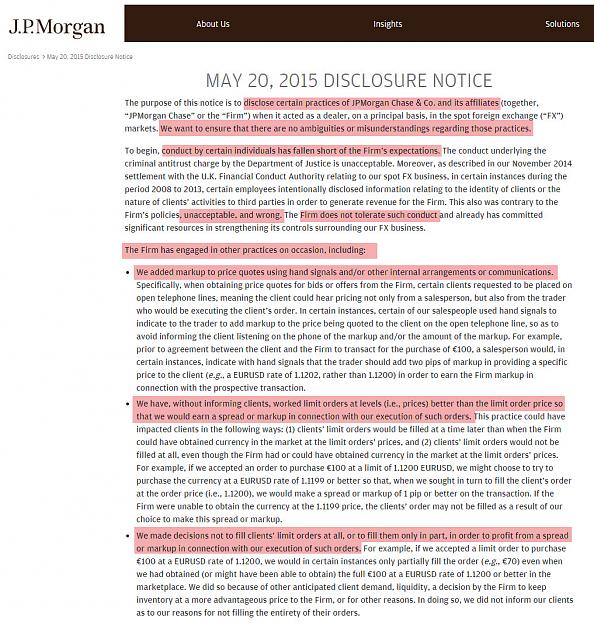

https://www.jpmorgan.com/pages/disclosures/fx_notice

Basically they confess to

Is it just me, or has there been an above-average incidence/clustering of "big names" being "exposed" for "misconduct" lately (Hollywood/News icons/Gov't/Banks). Guess I'm a bit of a conspiracy theorist.

Anyway this was published 2 days ago:

https://www.jpmorgan.com/pages/disclosures/fx_notice

Basically they confess to

- Using hand signals to instruct their traders to misquote prices to clients over the telephone in order to personally profit.

- Purposely neglecting to fill limit orders at the correct time, price, or volume (or at all) so as to personally profit.