For the traders that have years of experience, are profitable, and still use indicators, I'd like to know why you still use them.

Clearly there must be more to trading than taking an MA or MACD crossover and making millions. At this point, you must know at least something about trading

support and resistance, and market structure?. This leads to to wonder why you still want indicators on your charts.

Whenever I watch something online about trading, even traders on wallstreet and other trading firms always seem to have indicators on their charts.

Why is that?

I know many traders here, that trade purely price action, and there are several long lasting threads dedicated to the subject. I myself have been learning to trade without indicators for a while now, and learning to read market structure. But I won't lie, there is something about them that draws my attention, even though I feel they make trading more complex. But maybe it's just my nature, but I always find myself going back to price, reading the swing of the market and trying to find the TL's, channels, s/r zones etc..

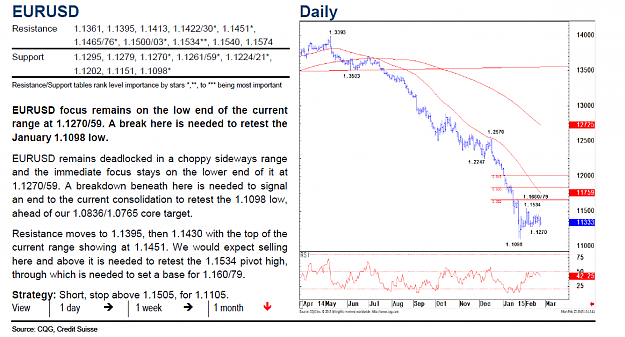

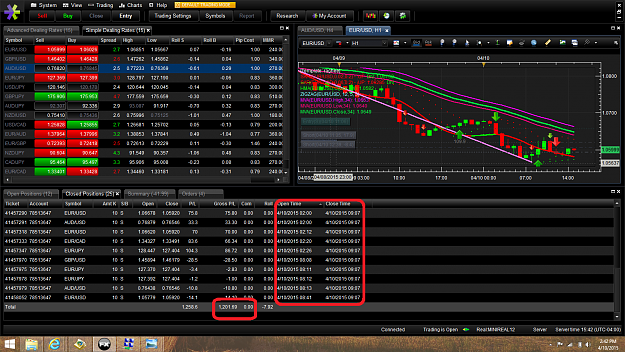

Just about 99.99% of threads in the "trading systems" page display charts like these:

Trading as simple as ABCD

THV system

When I see these charts, no offense to the OP's, but the first thing I think is "OMG, people understand all this?!". Yet both such threads are massively popular, boasting 5,000 replies and 25,000 replies respectively.

I feel trading should be made as simple as possible, and so it's my conclusion that indicator traders must belong to one of two groups. 1) Those that are highly intelligent and understand all the added information, or 2) Those that simply don't know any better.

But in a nutshell, I just want to know why successful traders continue to use indicators, and have not switched over to "naked" charts.

Clearly there must be more to trading than taking an MA or MACD crossover and making millions. At this point, you must know at least something about trading

support and resistance, and market structure?. This leads to to wonder why you still want indicators on your charts.

Whenever I watch something online about trading, even traders on wallstreet and other trading firms always seem to have indicators on their charts.

Why is that?

I know many traders here, that trade purely price action, and there are several long lasting threads dedicated to the subject. I myself have been learning to trade without indicators for a while now, and learning to read market structure. But I won't lie, there is something about them that draws my attention, even though I feel they make trading more complex. But maybe it's just my nature, but I always find myself going back to price, reading the swing of the market and trying to find the TL's, channels, s/r zones etc..

Just about 99.99% of threads in the "trading systems" page display charts like these:

Trading as simple as ABCD

THV system

When I see these charts, no offense to the OP's, but the first thing I think is "OMG, people understand all this?!". Yet both such threads are massively popular, boasting 5,000 replies and 25,000 replies respectively.

I feel trading should be made as simple as possible, and so it's my conclusion that indicator traders must belong to one of two groups. 1) Those that are highly intelligent and understand all the added information, or 2) Those that simply don't know any better.

But in a nutshell, I just want to know why successful traders continue to use indicators, and have not switched over to "naked" charts.