Interesting thread, i think its worth to try out. Even to see how you mastering your two big enemys #greed and #fear.

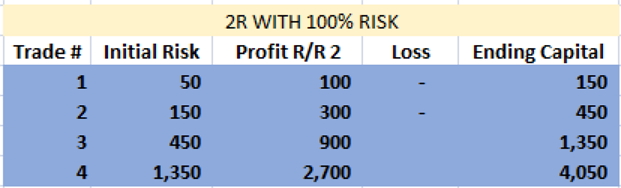

I have a fun account with 16$ and will try it out in the next days/months....

Let's see how far i can get

I have a fun account with 16$ and will try it out in the next days/months....

Let's see how far i can get

Pressure shapes Legends