Disliked{quote} First of all never try to test the market or major resistance levels/zones. The market will win every time. The mentality should be ..... how can I position myself to take advantage of what the chart is presenting to me! I kinda know what you were trying to say so I'm just having a friendly dig! I like the way you are starting to analyse your charts...that's good. The question you ask should be answered by yourself because it is you who pulls the trigger and takes the trade or not. You did not take the trade! I think you made the right decision!...Ignored

Thanks for your words, helpful as always.

Greetz Michael

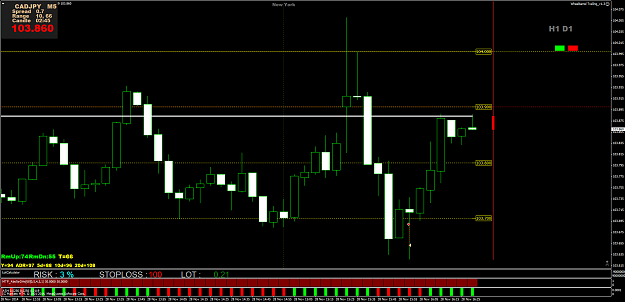

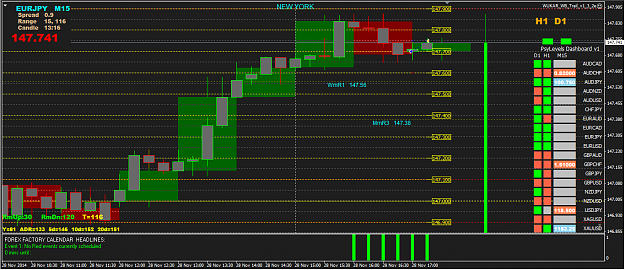

PS: Trade #4 GC to TP