Hi Panoramia , i am on forex factory since at least 6 years , and i went over the same road that some of the retail traders went true !! (i guess)

Finally , i am going over the thread and there is a lot of information here . I am a supply and demand trader and i was still searching for info , and i almost felt on the floor when i saw all the energy you spent here to share your experience with others . Thank you a million times for that !! have a nice day were ever you are !!

Alex

Finally , i am going over the thread and there is a lot of information here . I am a supply and demand trader and i was still searching for info , and i almost felt on the floor when i saw all the energy you spent here to share your experience with others . Thank you a million times for that !! have a nice day were ever you are !!

Alex

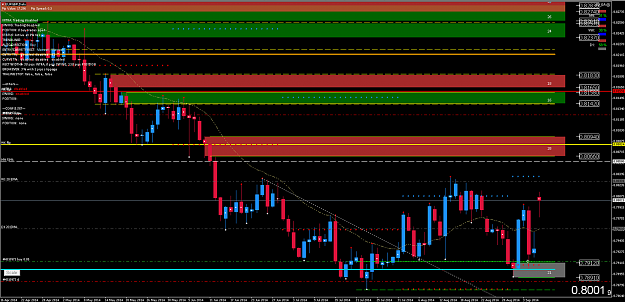

![Click to Enlarge

Name: 2014-09-12 00_07_26-9429615_ OANDA - MetaTrader - Demo Account - [NZDUSD,Daily].png

Size: 105 KB](/attachment/image/1507843/thumbnail?d=1410495008)