Hello All...another light bulb has turned on for me that clears up a lot of confusion I've had about the concept of price action and order flow. It is a concept I call market "pressure".

Now I may "touch a nerve" with some of you who believe the market is "rigged" or that a malevolent conspiracy exists that controls the market. But I ask your indulgence to just hear me out before dismissing me as another of the "mindless masses".

Order Flow - literally the flow of orders in the market over time. Assuming there are more buy orders than there are sell orders the price will tick higher to attract sellers to fill the buy orders - right? Well...not always. Let me explain.

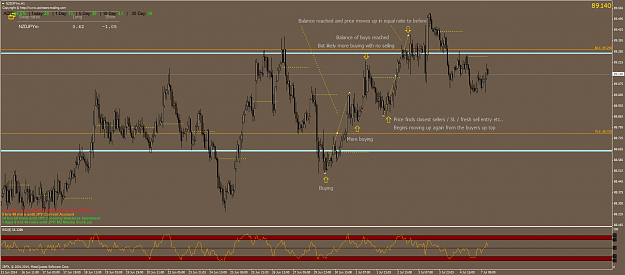

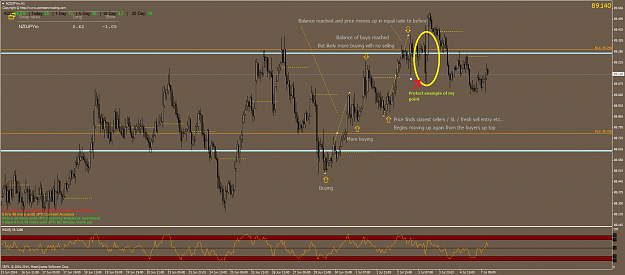

While the order flow concept is a sound one it doesn't explain what I've come to see an anomalous price action that defies explanation. I have been lucky enough to be able to code a reasonable proxy for order flow that allows me to "see" the orders that are filling in the market in real time...however, I have seen (again a bullish example), strong buying in the market yet prices are falling..and continue to fall. The opposite is true for a bearish example. From an order flow stand point this doesn't make sense and seems to negate or at least diminish the concept of - More demand higher prices...more supply lower prices. Other times I see a range form where there is a strong buying occurring inside that range, yet price breaks the bottom of the range...stalls then moves higher breaking the top of the range and moving one...(head fake). WHY in each of these instances is price moving lower in the face of buying...strong buying...

So I went back to the basics and studied market structure -- AGAIN! This time I began to see things a bit more clearly. As I've mentioned in my previous thread "Market Relativity" ( http://www.forexfactory.com/showthread.php?t=490690 ) I believe prices are the RESULT of market forces...not the cause, and that all those market forces are all relative to each other.

I believe I have found an additional market force that must be factored into the equation. "Market Pressure".

To understand this lets look at an example. Lets say you have a classic car that you love and would never part with. And one nice Sunday you drive it into town to a restaurant to have brunch. Three fellows there see your car and offer to buy it. One offers you $25,000. You say, "I'm sorry friend but this care is not for sale." The next fellow offers you $35,000. Again you refuse. The next fellow offers you $75,000. Again you don't want to sell. Then the first guy ups the bid to $150,000 saying, "son I just gotta have that car." This continues for a short while and a bidding war erupts between these three fellows. Each bidding more than the next. In this case - WHERE is the market pressure? All these buyers are putting an enormous pressure on YOU (the seller) to complete this transaction. The buyers are in a frenzy as prices rise but the PRESSURE is to sell...clear so far?

The greater pressure is most often opposite on the opposite side of the order flow or volume.

Now lets look at this in terms of market structure. The market (assuming a transparent and open one) is obligated to match buy and sell orders at the closes possible price. The most common is a buy and sell come in at a price with only 1-2 ticks difference and are matched. But what happens if a whole bunch of buy orders come in all at once and there are no matching sell orders? Most people think that prices will rise...but that doesn't always happen...

The market will match the CLOSEST sell order to the buy orders...so what happens if the closest sell order is BELOW the market? The market will tick DOWN to match that buy order with the sell order at the lower price...Then when the closest sell order is above the market...the price will start ticking higher...or may even JUMP higher.

Remember...more buyers than sellers = more selling pressure. For any of you who have moved your stop on your long to see it get stopped out and then move your way afterward...THIS IS WHAT's HAPPENING...it is not a conspiracy...it is market pressure and market structure. The market is merely matching the closest sell order with the flood of buy orders that are coming in...unfortunately your stop was among those sell orders...in fact many stops probably got hit...which is why price will hit those stops...pause and turn...then move higher. Think about this for a while...Market Pressure determines which WAY prices will move

So I must concentrate on rebalancing my formula to include market pressure. Higher buying volume means higher selling pressure. Once the sellers in one area are used up...prices will then rise...to the next area where there are sell orders. I haven't quite been able to quantify this yet but I am working on it.

Ideas? Comments? Keep them productive or constructive please

Now I may "touch a nerve" with some of you who believe the market is "rigged" or that a malevolent conspiracy exists that controls the market. But I ask your indulgence to just hear me out before dismissing me as another of the "mindless masses".

Order Flow - literally the flow of orders in the market over time. Assuming there are more buy orders than there are sell orders the price will tick higher to attract sellers to fill the buy orders - right? Well...not always. Let me explain.

While the order flow concept is a sound one it doesn't explain what I've come to see an anomalous price action that defies explanation. I have been lucky enough to be able to code a reasonable proxy for order flow that allows me to "see" the orders that are filling in the market in real time...however, I have seen (again a bullish example), strong buying in the market yet prices are falling..and continue to fall. The opposite is true for a bearish example. From an order flow stand point this doesn't make sense and seems to negate or at least diminish the concept of - More demand higher prices...more supply lower prices. Other times I see a range form where there is a strong buying occurring inside that range, yet price breaks the bottom of the range...stalls then moves higher breaking the top of the range and moving one...(head fake). WHY in each of these instances is price moving lower in the face of buying...strong buying...

So I went back to the basics and studied market structure -- AGAIN! This time I began to see things a bit more clearly. As I've mentioned in my previous thread "Market Relativity" ( http://www.forexfactory.com/showthread.php?t=490690 ) I believe prices are the RESULT of market forces...not the cause, and that all those market forces are all relative to each other.

I believe I have found an additional market force that must be factored into the equation. "Market Pressure".

To understand this lets look at an example. Lets say you have a classic car that you love and would never part with. And one nice Sunday you drive it into town to a restaurant to have brunch. Three fellows there see your car and offer to buy it. One offers you $25,000. You say, "I'm sorry friend but this care is not for sale." The next fellow offers you $35,000. Again you refuse. The next fellow offers you $75,000. Again you don't want to sell. Then the first guy ups the bid to $150,000 saying, "son I just gotta have that car." This continues for a short while and a bidding war erupts between these three fellows. Each bidding more than the next. In this case - WHERE is the market pressure? All these buyers are putting an enormous pressure on YOU (the seller) to complete this transaction. The buyers are in a frenzy as prices rise but the PRESSURE is to sell...clear so far?

The greater pressure is most often opposite on the opposite side of the order flow or volume.

Now lets look at this in terms of market structure. The market (assuming a transparent and open one) is obligated to match buy and sell orders at the closes possible price. The most common is a buy and sell come in at a price with only 1-2 ticks difference and are matched. But what happens if a whole bunch of buy orders come in all at once and there are no matching sell orders? Most people think that prices will rise...but that doesn't always happen...

The market will match the CLOSEST sell order to the buy orders...so what happens if the closest sell order is BELOW the market? The market will tick DOWN to match that buy order with the sell order at the lower price...Then when the closest sell order is above the market...the price will start ticking higher...or may even JUMP higher.

Remember...more buyers than sellers = more selling pressure. For any of you who have moved your stop on your long to see it get stopped out and then move your way afterward...THIS IS WHAT's HAPPENING...it is not a conspiracy...it is market pressure and market structure. The market is merely matching the closest sell order with the flood of buy orders that are coming in...unfortunately your stop was among those sell orders...in fact many stops probably got hit...which is why price will hit those stops...pause and turn...then move higher. Think about this for a while...Market Pressure determines which WAY prices will move

So I must concentrate on rebalancing my formula to include market pressure. Higher buying volume means higher selling pressure. Once the sellers in one area are used up...prices will then rise...to the next area where there are sell orders. I haven't quite been able to quantify this yet but I am working on it.

Ideas? Comments? Keep them productive or constructive please