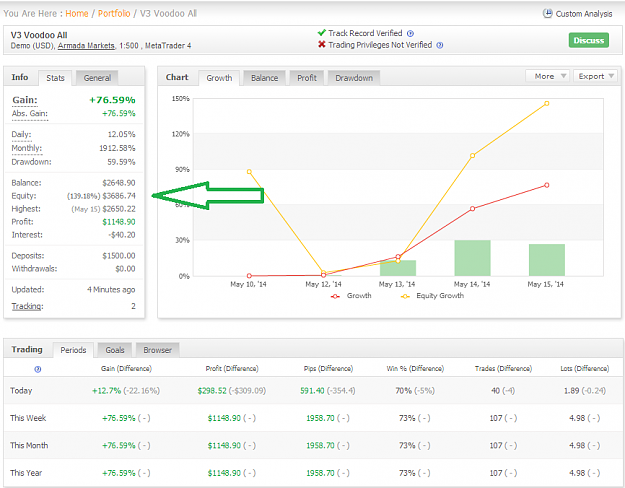

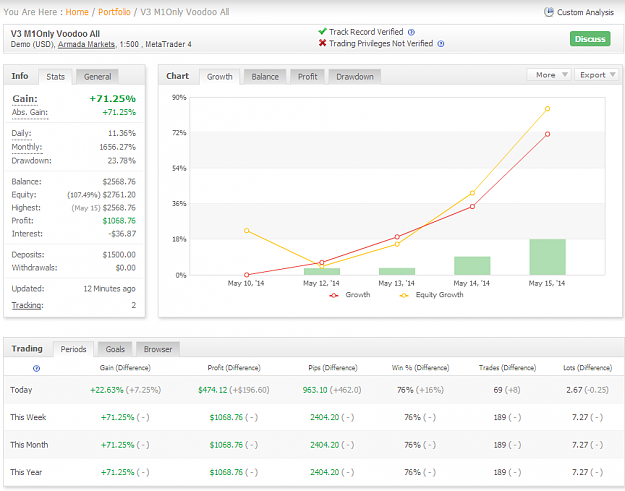

Is trading one minute time frame realistic in the sense that is it too chaotic or so chaotic that there are no tradable positions? So far, just demo-ing and playing around with the one minute time frame and various tick time frames to get a feel.

- Joined Feb 2009 | Status: Half in the Bag | 17,826 Posts

Money Can't Buy Happiness. Poverty Can't Buy SHIT! You Choose!