I had (a long time ago) posted about pascal's triangles and their use in Forex and in trading in general, this is an attempt to sort, organize, and cleanup all that information and have it located in a single place.

I think sometime in 2008(ish) I had a strange dream, very Kevin Costner Field of Dreams like. I was tackling the problem of optimized entry/re-entry/pyramiding of lot sizes. I recall that day on my private forum, stating "I woke up this morning and know the answer. The answer is Pascal's Triangle." I have no idea what that meant at the time, but as I investigated, I came upon quite the mathematical wonder that is the pascal's triangle, so I will make every attempt to explain it as best as I can below.

If you are trying to scale into, or scale out of, or pyramid into multiple positions, why is pascal's triangle a great choice?

Whenever we want to pyramid into a position, we would like to guarantee that the gradation of decrease in position size guarantees that the eventual sum of the gradation does NOT exceed the previous size. This is important so that if you have an open position, and decide to pyramid on that position, the additional positions at worst would make your original position break even, at best would leave you with a little bit of profit. In my search for such guarantees, I actually did find such guarantee; in the form of Phi.

Phi guarantees that, a singular phi-reduction step, and the sum of all it's subsequent steps, will __NOT__ exceed the original Phi entry point.

That is great photographically, but how do we put it mathematically? I discovered that we can do so somewhat easily by borrowing from the Fibonacci sequence.

In this example, given an initial entry @X as P0. Given the first pyramid point at X+34 as P1, we know that if P2 = is at X +34 + 21, with a positional SL at X+34+21-13, we can ALWAYS GUARANTEE that a pyramid action does no compromise the integrity of the average up. Thus this can be used for internally optimized and guaranteed SL pip-distance calculations.

Given the relationship then of asymptotically fib ratio approaching phi;

We then look at a Fib chart to maximize the potential of such use.

As your profit is really a mixture of lot size X distance covered; we can thus apply the same thing not just to distance, but to lot size as well.

1,1,2,3,5,8,13,21,34,55,89

Given a entry of 8.9 Lots;

An excellent pyramid point would be purchasing 3.4 lots when that position is showing a +55 pip profit.

The third pyramid point would then be 1.3 lots when the 2nd position is showing an open + 21 pip profit.

In doing so; you internally maximize risk reward to near optimized ratios; without the need to actually do the heavy lifting.

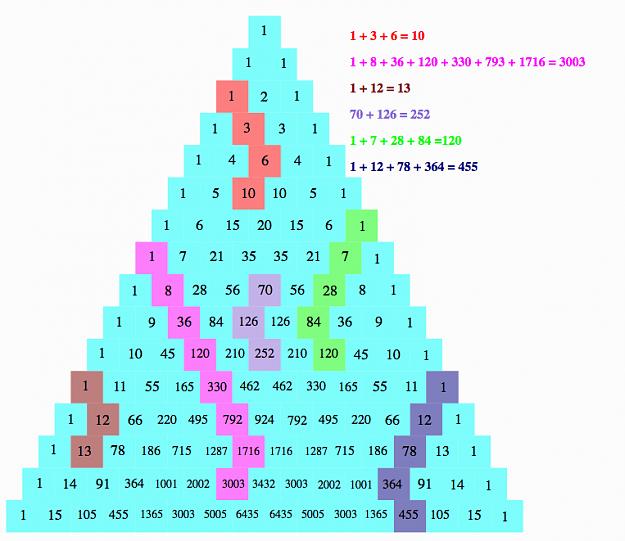

Since Pascal's Triangle is nothing more than a matrix view of the Fibonacci sequence;

We can then apply the pascal's triangle to our advantage.

Within the pascal's triangle, if you move one level down from left to right, if your final movement is bent the opposite; (from right to left) then you will obtain the sum of that amount.

Thus giving the characteristic "Hockey Stick" look.

I will go ahead and take the Orange hockey stick as an example from above. (21,15,5,1)

Given that I would like to pyramid up in symmetric intervals, say at +20 pips, and would like to do so for up to 4 times before I exit my position because I think +80 pips is very realistic in say, EURUSD, I take a look at the and pick the Orange Hockey Stick.

Given initial entry @X0. Initial price entry point (P), Lot size = 2.1

Conservative: I pick -28 pips as my SL. So P-28 = SL.

Moderate: I pick -35 pips as my SL. So P-35 = SL.

Aggressive: I pick -56 pips as my SL. So P-56 = SL.

(Note, my SL's are all picked around the last number on the orange hockey stick, the #21.)

At P+20, I enter again, 1.5 lots

At P+20+20 I enter again, 0.5 lots

At P+20+20+20 I enter again, 0.1 lots

At P+20+20+20+20 I exit all positions and take profit.

That's a fixed pip interval hockey stick pyramid; by manipulation of lot size only.

Here's a variation on that, non-fixed interval.

Given initial entry @X0. Initial price entry point (P), Lot size = 2.1

Conservative: I pick -28 pips as my SL. So P-28 = SL.

Moderate: I pick -35 pips as my SL. So P-35 = SL.

Aggressive: I pick -56 pips as my SL. So P-56 = SL.

When we reach P+21, we enter a 2nd time, (@X1), Lot size = 1.5

When we reach P+21+15, we enter a 3rd time (@X2), Lot size = 0.5

When we reach P+21+15+5...

I normally wouldn't bother with the final pyramid, and would just exit at this point.

This is using the pascal's triangle to optimize both lot size as well as interval.

If you are somewhat conservative or the market is thrashing about and you are not that secure; you can then this and have either a trailing SL or 28,34,or 56, depending on your risk tolerance.

If you sit there and crunch out the numbers as I'm sure some of you will; it is not fully fully optimized but pretty darn close! You don't need to then run a 3 variable chart of optimization for interval, lot size, and SL. The pascal's triangle does all that for you!!

The next example is a is what I call a "Pascal Leftie".

For this example I will be using the blue/purple hockey stick with the series (84,56,21,6,1)

Given initial position @X0, P, Lot size = 8.4, SL@P-45 (Stay with me here)

Given the purple hockey stick to be the position size; I will use the hex to the LEFT of it as my interval. So it will look like:

Given X0, P, LS =8.4, SL=P-45

X1 = P+36, LS = 5.6, SL = P+36-45

X2 = P+36+28, LS = 2.1, SL = P+28+36-45

X3 = P+36+28+7, LS = 0.6, SL = P+7+28+36-45 OR in my case, I usually just exit all positions here.

I use the hockey stick itself as the lot size determinant, and the hex to the left of it as my interval.

There are many MANY other methods to use the hockey sticks, too many to mention as I'm sure this will drum up some drastic discussions; but know that it is to be used first and foremost for good; and also never EVER EVER EVER use it to average down (you should never average down anyways).

I'm sure there will be a billion questions, I will do the best I can to answer them, but I hope I have made a decent introduction to the world of use of pascal's triangle as a pre-made solution to near fully optimized chart for pyramiding without the heavy math involved for optimizational determinants.

I think sometime in 2008(ish) I had a strange dream, very Kevin Costner Field of Dreams like. I was tackling the problem of optimized entry/re-entry/pyramiding of lot sizes. I recall that day on my private forum, stating "I woke up this morning and know the answer. The answer is Pascal's Triangle." I have no idea what that meant at the time, but as I investigated, I came upon quite the mathematical wonder that is the pascal's triangle, so I will make every attempt to explain it as best as I can below.

If you are trying to scale into, or scale out of, or pyramid into multiple positions, why is pascal's triangle a great choice?

Whenever we want to pyramid into a position, we would like to guarantee that the gradation of decrease in position size guarantees that the eventual sum of the gradation does NOT exceed the previous size. This is important so that if you have an open position, and decide to pyramid on that position, the additional positions at worst would make your original position break even, at best would leave you with a little bit of profit. In my search for such guarantees, I actually did find such guarantee; in the form of Phi.

Attached Image

Phi guarantees that, a singular phi-reduction step, and the sum of all it's subsequent steps, will __NOT__ exceed the original Phi entry point.

That is great photographically, but how do we put it mathematically? I discovered that we can do so somewhat easily by borrowing from the Fibonacci sequence.

Attached Image

In this example, given an initial entry @X as P0. Given the first pyramid point at X+34 as P1, we know that if P2 = is at X +34 + 21, with a positional SL at X+34+21-13, we can ALWAYS GUARANTEE that a pyramid action does no compromise the integrity of the average up. Thus this can be used for internally optimized and guaranteed SL pip-distance calculations.

Given the relationship then of asymptotically fib ratio approaching phi;

Attached Image

We then look at a Fib chart to maximize the potential of such use.

As your profit is really a mixture of lot size X distance covered; we can thus apply the same thing not just to distance, but to lot size as well.

1,1,2,3,5,8,13,21,34,55,89

Given a entry of 8.9 Lots;

An excellent pyramid point would be purchasing 3.4 lots when that position is showing a +55 pip profit.

The third pyramid point would then be 1.3 lots when the 2nd position is showing an open + 21 pip profit.

In doing so; you internally maximize risk reward to near optimized ratios; without the need to actually do the heavy lifting.

Since Pascal's Triangle is nothing more than a matrix view of the Fibonacci sequence;

Attached Image

We can then apply the pascal's triangle to our advantage.

Within the pascal's triangle, if you move one level down from left to right, if your final movement is bent the opposite; (from right to left) then you will obtain the sum of that amount.

Thus giving the characteristic "Hockey Stick" look.

Attached Image

I will go ahead and take the Orange hockey stick as an example from above. (21,15,5,1)

Given that I would like to pyramid up in symmetric intervals, say at +20 pips, and would like to do so for up to 4 times before I exit my position because I think +80 pips is very realistic in say, EURUSD, I take a look at the and pick the Orange Hockey Stick.

Given initial entry @X0. Initial price entry point (P), Lot size = 2.1

Conservative: I pick -28 pips as my SL. So P-28 = SL.

Moderate: I pick -35 pips as my SL. So P-35 = SL.

Aggressive: I pick -56 pips as my SL. So P-56 = SL.

(Note, my SL's are all picked around the last number on the orange hockey stick, the #21.)

At P+20, I enter again, 1.5 lots

At P+20+20 I enter again, 0.5 lots

At P+20+20+20 I enter again, 0.1 lots

At P+20+20+20+20 I exit all positions and take profit.

That's a fixed pip interval hockey stick pyramid; by manipulation of lot size only.

Here's a variation on that, non-fixed interval.

Given initial entry @X0. Initial price entry point (P), Lot size = 2.1

Conservative: I pick -28 pips as my SL. So P-28 = SL.

Moderate: I pick -35 pips as my SL. So P-35 = SL.

Aggressive: I pick -56 pips as my SL. So P-56 = SL.

When we reach P+21, we enter a 2nd time, (@X1), Lot size = 1.5

When we reach P+21+15, we enter a 3rd time (@X2), Lot size = 0.5

When we reach P+21+15+5...

I normally wouldn't bother with the final pyramid, and would just exit at this point.

This is using the pascal's triangle to optimize both lot size as well as interval.

If you are somewhat conservative or the market is thrashing about and you are not that secure; you can then this and have either a trailing SL or 28,34,or 56, depending on your risk tolerance.

If you sit there and crunch out the numbers as I'm sure some of you will; it is not fully fully optimized but pretty darn close! You don't need to then run a 3 variable chart of optimization for interval, lot size, and SL. The pascal's triangle does all that for you!!

The next example is a is what I call a "Pascal Leftie".

For this example I will be using the blue/purple hockey stick with the series (84,56,21,6,1)

Given initial position @X0, P, Lot size = 8.4, SL@P-45 (Stay with me here)

Given the purple hockey stick to be the position size; I will use the hex to the LEFT of it as my interval. So it will look like:

Given X0, P, LS =8.4, SL=P-45

X1 = P+36, LS = 5.6, SL = P+36-45

X2 = P+36+28, LS = 2.1, SL = P+28+36-45

X3 = P+36+28+7, LS = 0.6, SL = P+7+28+36-45 OR in my case, I usually just exit all positions here.

I use the hockey stick itself as the lot size determinant, and the hex to the left of it as my interval.

There are many MANY other methods to use the hockey sticks, too many to mention as I'm sure this will drum up some drastic discussions; but know that it is to be used first and foremost for good; and also never EVER EVER EVER use it to average down (you should never average down anyways).

I'm sure there will be a billion questions, I will do the best I can to answer them, but I hope I have made a decent introduction to the world of use of pascal's triangle as a pre-made solution to near fully optimized chart for pyramiding without the heavy math involved for optimizational determinants.

google: