This thread is (for now) GbpUsd H4 charts ONLY. I still am looking at other pairs but using this method the GbpUsd has made an average of 4 pips for every -1 pips since June.

++++++++++++++++++++++++++++++++

Have been busy at work on H1 charts. What I'm going to show you here is nothing new. It's basically support & resistance on one hour charts. H1 charts look the same to everyone in the world except in India, I would imagine, since all, or most of India is 1/2 hour different then most other locations on earth.

The idea for this set up was presented to me by someone I call a friend, fxpivots. Although the core set up is not an exact match for his ideas, that is where I came up with this, so thank you fxpivots.

I'm hoping that I can get some help to suss out the basics presented here. One major improvement would be an EA to handle stops. The trade itself will can be handle comfortably (most of the time) using pending (limit) orders.

If you have any ideas I would appreciate the help. One thing I am 100% opposed to is charts that look like an acid trip. In other words, I currently use no indicators at all. I may add one that draws previous days hi/low and that's all I see that fits. If you have some crazy ideas about a bunch of indicators, please do not post here. Send the ideas to me via pm on FF. My main thrust is to keep this as simple as possible. I thank everyone in advance.

One other thing that will not be tolerated is 'pissing contests'. If you take issue with me or anyone else on this thread, please handle it elsewhere. Those that insist on insults & browbeating others will be booted.

Thanks,

Darryl

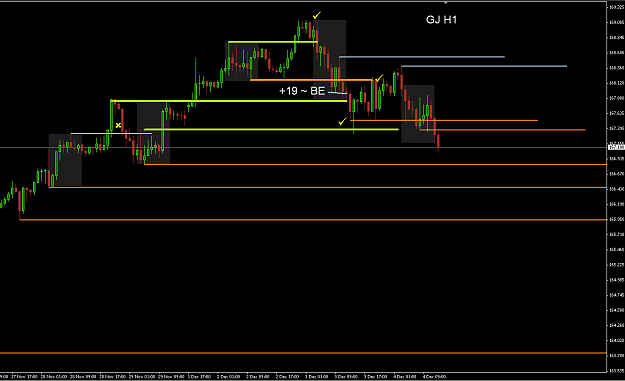

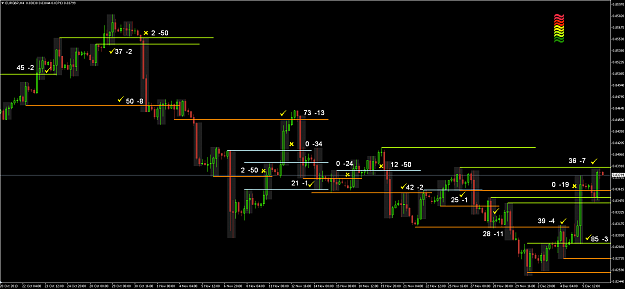

Before I talk about the set up, let me show you 2 screenshots that explain most of the basics of this set up.

• Lighter gray box is London open to close. Smaller darker gray box is first four hours of NY session.

• At this point most of my testing has been on EU.

++++++++++++++++++++++++++++++++

Have been busy at work on H1 charts. What I'm going to show you here is nothing new. It's basically support & resistance on one hour charts. H1 charts look the same to everyone in the world except in India, I would imagine, since all, or most of India is 1/2 hour different then most other locations on earth.

The idea for this set up was presented to me by someone I call a friend, fxpivots. Although the core set up is not an exact match for his ideas, that is where I came up with this, so thank you fxpivots.

I'm hoping that I can get some help to suss out the basics presented here. One major improvement would be an EA to handle stops. The trade itself will can be handle comfortably (most of the time) using pending (limit) orders.

If you have any ideas I would appreciate the help. One thing I am 100% opposed to is charts that look like an acid trip. In other words, I currently use no indicators at all. I may add one that draws previous days hi/low and that's all I see that fits. If you have some crazy ideas about a bunch of indicators, please do not post here. Send the ideas to me via pm on FF. My main thrust is to keep this as simple as possible. I thank everyone in advance.

One other thing that will not be tolerated is 'pissing contests'. If you take issue with me or anyone else on this thread, please handle it elsewhere. Those that insist on insults & browbeating others will be booted.

Thanks,

Darryl

Before I talk about the set up, let me show you 2 screenshots that explain most of the basics of this set up.

• Lighter gray box is London open to close. Smaller darker gray box is first four hours of NY session.

• At this point most of my testing has been on EU.