Dislikedguys my internet very slow can not view the video where is entry point in system ؟Ignored

I have a slow connection too and have found it's easiest to watch online videos after they have been downloaded to my computer.

My favorite downloader for YouTube or anything else is Internet Download Manager but you have to pay for it after the trial period. IDM works very well for multiple downloads.

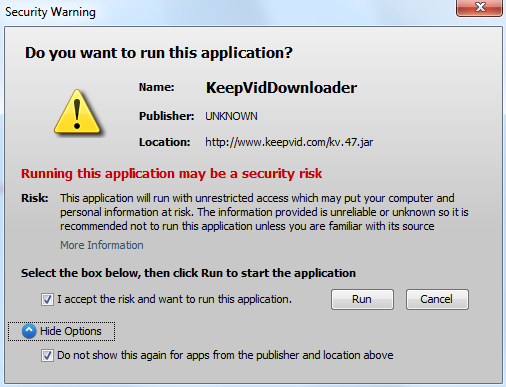

You also can download YouTube videos for free at www.keepvid.com. You have to give the application permission to run:

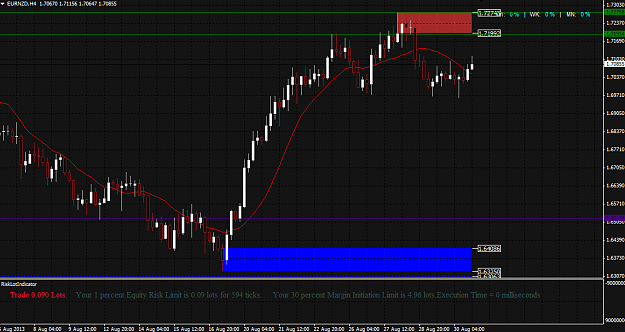

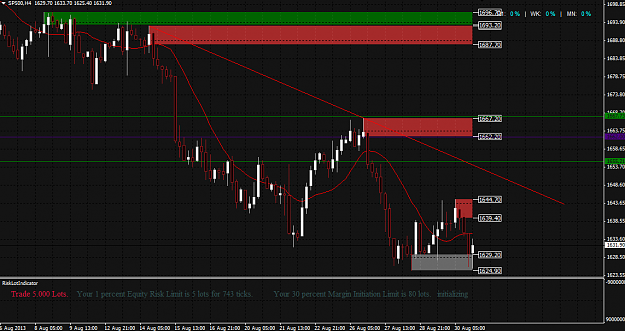

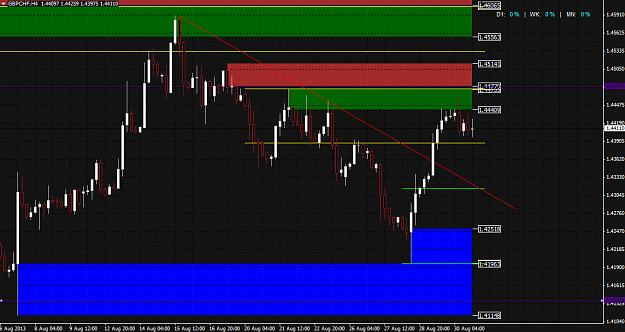

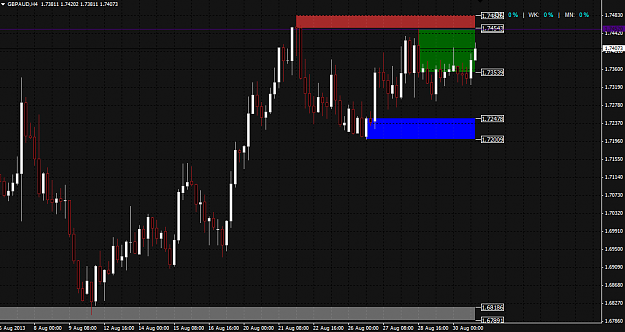

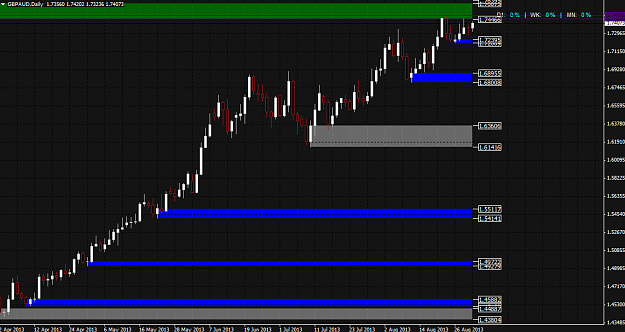

Attached Image