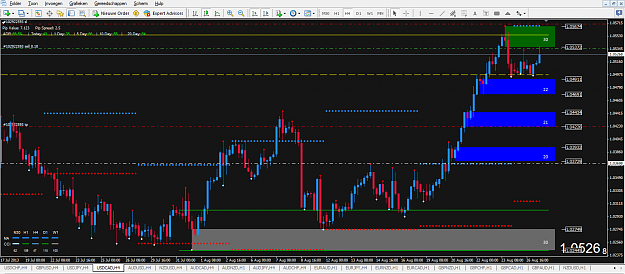

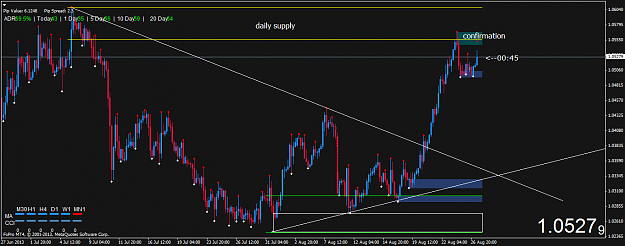

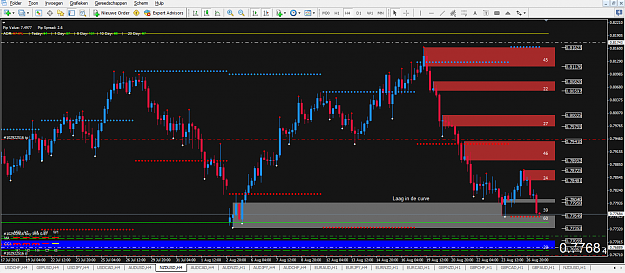

DislikedAlfonso, What do you think of my limit order on AUDNZD 1H? Daily supply is in control. Departure wasn't very good, but it is still valid going by our rules. {image}Ignored

Just look at the H4 chart and you will see what I mean. Those 2 H4 supply areas have MUCH higher odds of working than the H1 area you have yours.

Hope that makes sense to you Axlz!

Set and Forget supply and demand trading community