Hi Alfonso,

Thank you for this . Your explanation is crystal clear.

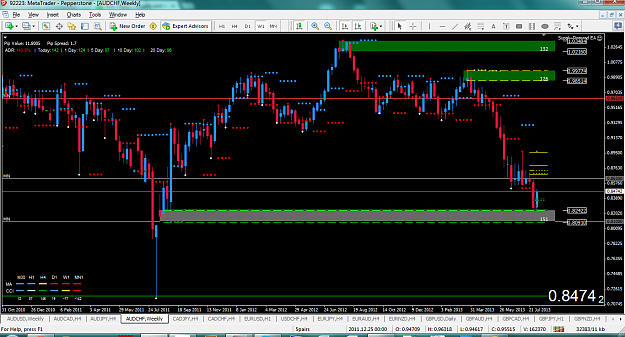

To make the journey easier, how many consistent loser have you had in a row, and how many consistent winners have you had in a row. From what i see you trade about 26 pairs. Do you have a rule of max trades or do you take every setup on every pair.

also on average how many trades do you take per month

Just trying the understand the psychological aspects of this style of trading.

Finally what sort of monthly returns would you expect. We can assume the risk is 1%. In a nutshell it might be good for everyone to understand the journey. Too often we have a string of losers and we stop trading, or we have a string of winners and we over trade. With 26pairs we need to be careful of how much to risk. An event driven risk can easily wipe the account if we risk about 2% per trade.

Thanks

Ash

Thank you for this . Your explanation is crystal clear.

To make the journey easier, how many consistent loser have you had in a row, and how many consistent winners have you had in a row. From what i see you trade about 26 pairs. Do you have a rule of max trades or do you take every setup on every pair.

also on average how many trades do you take per month

Just trying the understand the psychological aspects of this style of trading.

Finally what sort of monthly returns would you expect. We can assume the risk is 1%. In a nutshell it might be good for everyone to understand the journey. Too often we have a string of losers and we stop trading, or we have a string of winners and we over trade. With 26pairs we need to be careful of how much to risk. An event driven risk can easily wipe the account if we risk about 2% per trade.

Thanks

Ash