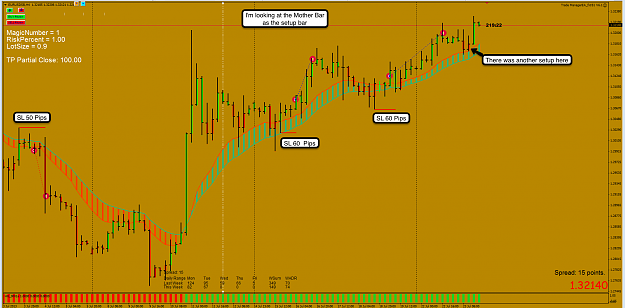

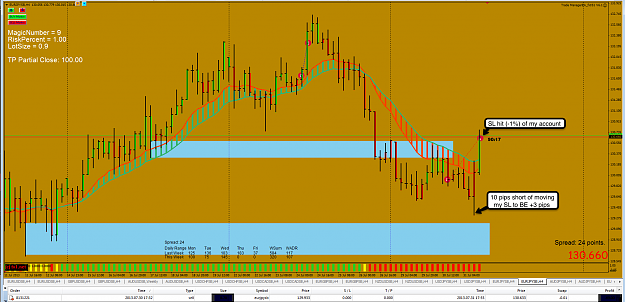

Disliked{quote} Steve Can you maybe please elaborate on your quote for setting your Stop Loss above or below the setup candle. If I look at your first posted chart with the 2 trades, on the first trade after you have entered you do get a lower candle. Would this not have taken out a SL? I am trading a similar 5/8 EMA system but would like to get the SL placement more optimized as I think mine is very wide (100-300pips on a 4H/Daily timeframe) and RR could be suffering because of this.Ignored

There is no guaranteed solution to this. Just use the methid that makes the most sense to your risks appetite.