Disliked{quote} I think it will reemerge once equities flop over. Right now there is no incentive to carry Aussie because their is better yielding assets right now. When that happens Aussie should pop hard, but untill then there is no point.Ignored

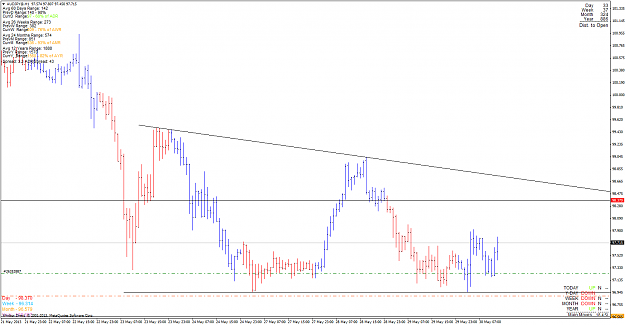

Aussie down fall is not just because of yields lowering. It certainly was the catalyst for enough large bets to be placed, to cause the price to fall.

I think even more so than the rate cut, Aussie was dying for a technical correction on a 5 year scale.

Even if the RBA didn't cut, it couldn't have just consolidated between parity and 1.06 for all eternity. Even if policy didn't chance between the FED or the RBA for the next 50 years, Aussie would have broke down below parity eventually.

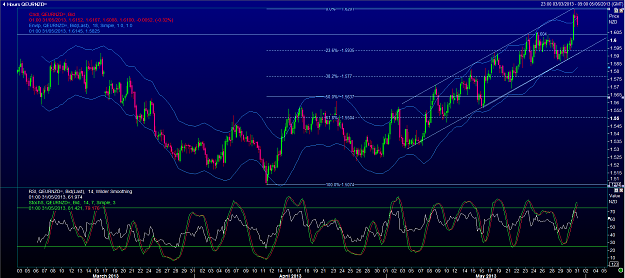

Besides, now that Aussie has dropped so much (although I wouldn't consider it "cheap" yet), and equities have not, equities look far riskier to me.

Other than the fact that the FED and other central banks secretly (well not so secretly anymore) buy U.S. equities, and that the SP500 grows almost directly inline with the FEDs balance sheet, I see no reason to buy all time highs on the premise of a "breakout".

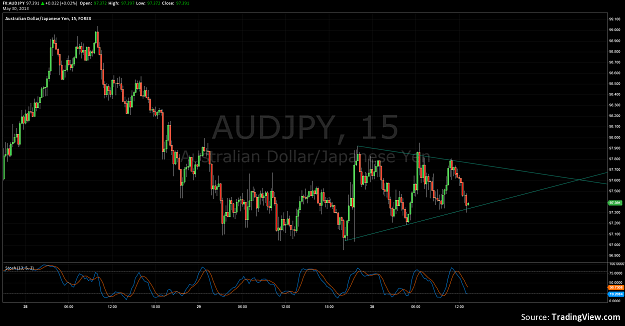

I trade markets back into the range 90% of the time, breakouts of the range maybe 10%. I look for weak liquidity in a move (price spikes) and then fade them.

Be hopeful in a winning position, and fearful in a losing position.