If we can barely recognize and trade the trend in one currency pair, what makes it a good idea to use the information or even trade multiple of the "traditionally" correlated pairs?

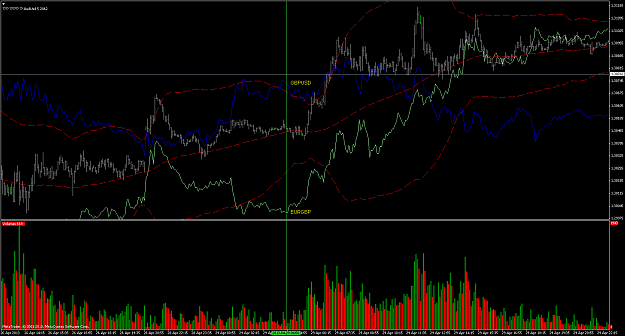

The most classic negatively correlated pair is EUR/USD and USD/CHF. Yet that correlation is broken yesterday. EU was already bullish after the 100 pips down movement, yet UF did not turn bearish at all and kept going up instead.

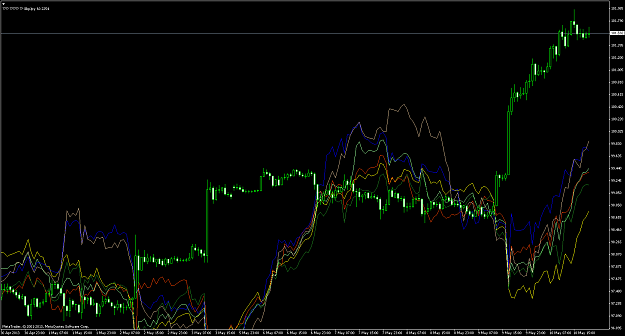

Another classic is all the JPY pairs. When one is down, the other tends to move simultaneously or lag a little. But when all pairs are down, what makes you think that you can trade any of the pair and price will not reverse in all pairs? Yesterday's nasty spike on all the JPY pairs proves that they move simultaneously and there is no advantage of knowing what other JPY pairs are doing. If you're long in any one of them, what correlation information can save you from the spike?

Questions:

The most classic negatively correlated pair is EUR/USD and USD/CHF. Yet that correlation is broken yesterday. EU was already bullish after the 100 pips down movement, yet UF did not turn bearish at all and kept going up instead.

Another classic is all the JPY pairs. When one is down, the other tends to move simultaneously or lag a little. But when all pairs are down, what makes you think that you can trade any of the pair and price will not reverse in all pairs? Yesterday's nasty spike on all the JPY pairs proves that they move simultaneously and there is no advantage of knowing what other JPY pairs are doing. If you're long in any one of them, what correlation information can save you from the spike?

Questions:

- How can you use correlation when every time frame gives you a different correlation data? 5 min correlation is different than hourly, daily, or weekly correlation.

- How can you use correlation when the correlation itself changes over time? What is considered to be correlated today will not be by next week/month/year.

- How can you use correlation indicators that simply display up and down arrows of what other currencies are doing? It all depends on the algorithm of course, but what I've seen so far is that they change by minutes and as soon as you see all arrows pointing up or down, under what rational do you think that price will not reverse?

I think currency pairs/commodities/indices/stock/futures are always correlated, but the correlation itself is not tradeable.

I would love to hear from you if you are a profitable correlation trader.