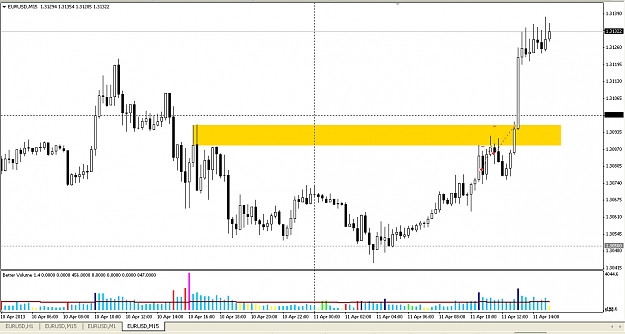

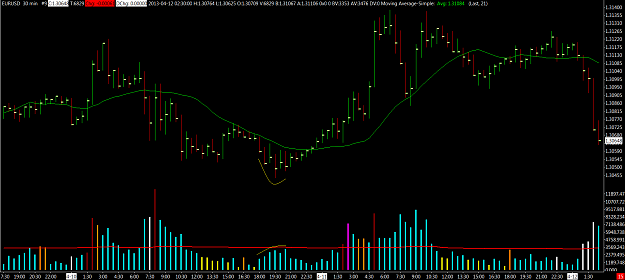

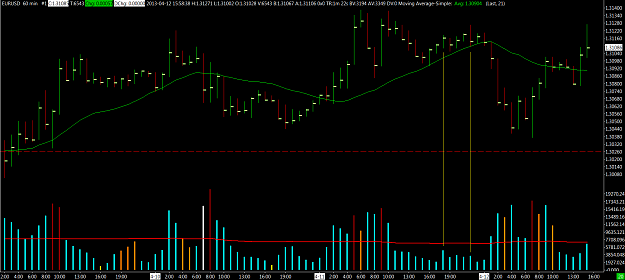

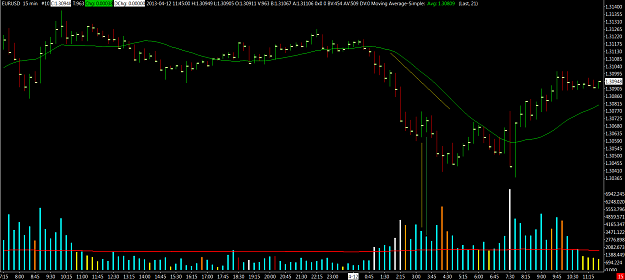

DislikedI just love it! I will put the pictures without commentaries(well, at least not long commentaries...) for your appreciation. It is the audusd today. The news: {image} And the price action(15min chart): {image} Beautiful, isn't it?Ignored

- Post #23,961

- Quote

- Apr 11, 2013 6:36am Apr 11, 2013 6:36am

- Joined Oct 2010 | Status: Looking at a few more charts... | 1,195 Posts

- Post #23,962

- Quote

- Apr 11, 2013 6:43am Apr 11, 2013 6:43am

- Joined Oct 2010 | Status: Looking at a few more charts... | 1,195 Posts

- Post #23,963

- Quote

- Apr 11, 2013 7:45am Apr 11, 2013 7:45am

- | Joined May 2011 | Status: Member | 263 Posts

- Post #23,964

- Quote

- Apr 11, 2013 8:07am Apr 11, 2013 8:07am

- | Joined May 2011 | Status: Member | 263 Posts

- Post #23,967

- Quote

- Apr 11, 2013 1:09pm Apr 11, 2013 1:09pm

- Joined Aug 2009 | Status: Reading the TAPE | 2,334 Posts

Wyckoff VSA: (1) Supply & Demand (2) Effort vs. Result (3) Cause & Effect

- Post #23,968

- Quote

- Apr 11, 2013 2:01pm Apr 11, 2013 2:01pm

- Joined Aug 2009 | Status: Reading the TAPE | 2,334 Posts

Wyckoff VSA: (1) Supply & Demand (2) Effort vs. Result (3) Cause & Effect

- Post #23,969

- Quote

- Apr 12, 2013 12:15am Apr 12, 2013 12:15am

- | Joined May 2011 | Status: Member | 263 Posts

- Post #23,970

- Quote

- Apr 12, 2013 2:05am Apr 12, 2013 2:05am

The loss was not bad luck. It was bad Analysis - D.Einhorn

- Post #23,971

- Quote

- Apr 12, 2013 5:24am Apr 12, 2013 5:24am

- | Joined May 2011 | Status: Member | 263 Posts

- Post #23,972

- Quote

- Apr 12, 2013 7:26am Apr 12, 2013 7:26am

- Joined Oct 2010 | Status: Looking at a few more charts... | 1,195 Posts

- Post #23,973

- Quote

- Apr 13, 2013 2:59am Apr 13, 2013 2:59am

- | Joined May 2011 | Status: Member | 263 Posts

- Post #23,974

- Quote

- Apr 13, 2013 9:04am Apr 13, 2013 9:04am

- Joined Oct 2010 | Status: Looking at a few more charts... | 1,195 Posts

- Post #23,975

- Quote

- Apr 13, 2013 9:05am Apr 13, 2013 9:05am

The loss was not bad luck. It was bad Analysis - D.Einhorn

- Post #23,980

- Quote

- Apr 14, 2013 2:39am Apr 14, 2013 2:39am

- | Joined May 2011 | Status: Member | 263 Posts