Decided to start another trading journal to look at a mechanical trader method i have been looking at.

It's in no way all my own work I have gleaned a lot of information from this thread http://www.forexfactory.com/showthread.php?t=252157 started by Paulus I was looking for a trend following technique that would work mechanically and thanks to Paulus for all his hard work.

Paulus was using this method on short time frames (TFs) I'm using it on 4h charts and so far so good.

Why do I want something that will work mechanically? well that's easy, I was getting very frustrated trading price action on lower TFs. mostly 15m, and getting it wrong more times than not.

This, for me, takes away the stress of trading lower TFs and makes trading fun.

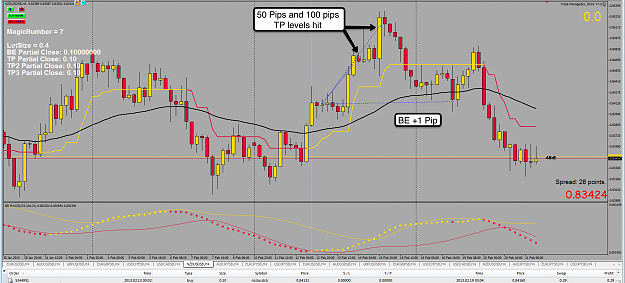

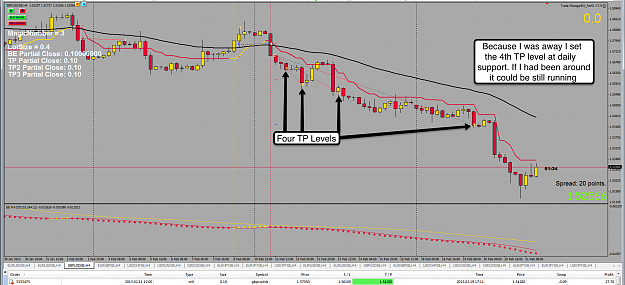

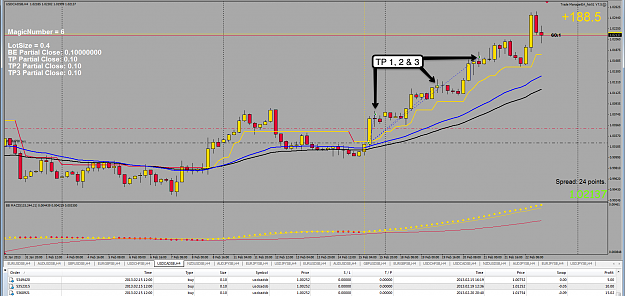

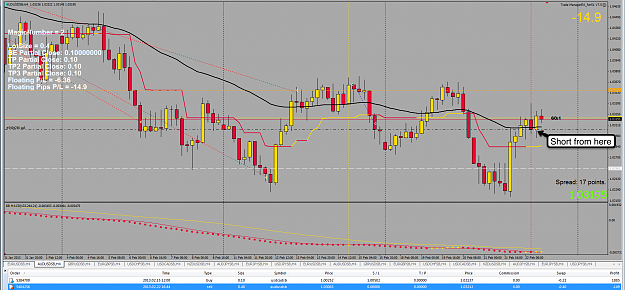

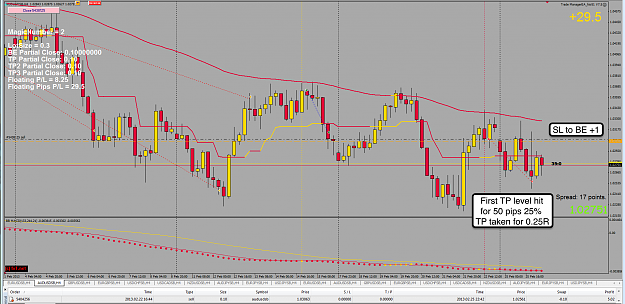

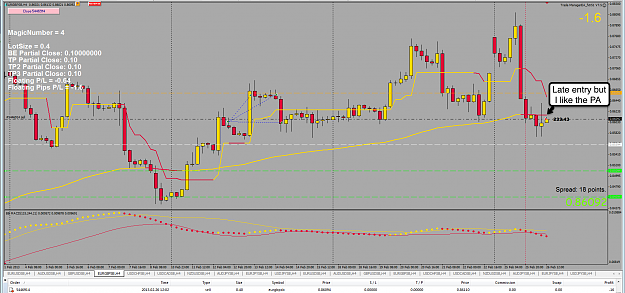

Once I see a set up I enter with 0.4 lots and an initial SL of 50 pips, once I get to 50 pips profit I exit 25% of my position and move my SL to BE +1, at 100 pips I exit another 25%, at 150 pips I exit another 25% I then tighten my SL and allow the remaining 25% to run.

Once I'm in a trade I use this Stealth TradeManager EA for MT4 http://www.forexfactory.com/showthread.php?t=371147 for trade management. If you want to know how to set this EA up it's much easier to follow the instructions provided here. Thanks to Fxtr51 for all his programming skills.

I use the BB MACD and SuperTrend+MA indicators

And no the indicators don't repaint, they only change whilst the candle you are watching forms so only look to enter a trade once the candle is complete.

I use the same settings for the BB MACD indicator as Paulus 133 244 2.1 the SuperTrend indicator I use MAPeriod 50, MA Method 1, MA Price 0 and don't forget to set ShowMA to TRUE.

I've attached a GBP/USD 4h chart to so show what I'm looking for.

I'm tracking 10 pairs EUR/USD, AUD/USD,GBP/USD,EUR/GBP,USD/CHF,USD/CAD,NZD/USD,AUD/JPY/EUR/JPY,USD/JPY if your interested try some back testing over the weekend you might be pleasantly surprised at the results.

The beauty of this is it's simplicity so don't try to fix what isn't broke until you have given it a try.

On the 26th Feb 13 i added the AllAverages v2.1 indicator with Inputs set to (TimeFrame 0) (Price 0) (MA Period 50) (MA Shift 0) (MA Method 2)

Change the SuprerTrend indicator in the Inputs set the (ShowMA false)

From the 11th Mar 2013 I'm only watching EUR/USD GBP/USD USD/CHF USD/CAD USD/JPY EUR/JPY

On the 15th March 13 I added the scmtf cci indicator see page 5 post 63

It's in no way all my own work I have gleaned a lot of information from this thread http://www.forexfactory.com/showthread.php?t=252157 started by Paulus I was looking for a trend following technique that would work mechanically and thanks to Paulus for all his hard work.

Paulus was using this method on short time frames (TFs) I'm using it on 4h charts and so far so good.

Why do I want something that will work mechanically? well that's easy, I was getting very frustrated trading price action on lower TFs. mostly 15m, and getting it wrong more times than not.

This, for me, takes away the stress of trading lower TFs and makes trading fun.

Once I see a set up I enter with 0.4 lots and an initial SL of 50 pips, once I get to 50 pips profit I exit 25% of my position and move my SL to BE +1, at 100 pips I exit another 25%, at 150 pips I exit another 25% I then tighten my SL and allow the remaining 25% to run.

Once I'm in a trade I use this Stealth TradeManager EA for MT4 http://www.forexfactory.com/showthread.php?t=371147 for trade management. If you want to know how to set this EA up it's much easier to follow the instructions provided here. Thanks to Fxtr51 for all his programming skills.

I use the BB MACD and SuperTrend+MA indicators

And no the indicators don't repaint, they only change whilst the candle you are watching forms so only look to enter a trade once the candle is complete.

I use the same settings for the BB MACD indicator as Paulus 133 244 2.1 the SuperTrend indicator I use MAPeriod 50, MA Method 1, MA Price 0 and don't forget to set ShowMA to TRUE.

I've attached a GBP/USD 4h chart to so show what I'm looking for.

I'm tracking 10 pairs EUR/USD, AUD/USD,GBP/USD,EUR/GBP,USD/CHF,USD/CAD,NZD/USD,AUD/JPY/EUR/JPY,USD/JPY if your interested try some back testing over the weekend you might be pleasantly surprised at the results.

The beauty of this is it's simplicity so don't try to fix what isn't broke until you have given it a try.

On the 26th Feb 13 i added the AllAverages v2.1 indicator with Inputs set to (TimeFrame 0) (Price 0) (MA Period 50) (MA Shift 0) (MA Method 2)

Change the SuprerTrend indicator in the Inputs set the (ShowMA false)

From the 11th Mar 2013 I'm only watching EUR/USD GBP/USD USD/CHF USD/CAD USD/JPY EUR/JPY

On the 15th March 13 I added the scmtf cci indicator see page 5 post 63

Attached File(s)