Is going

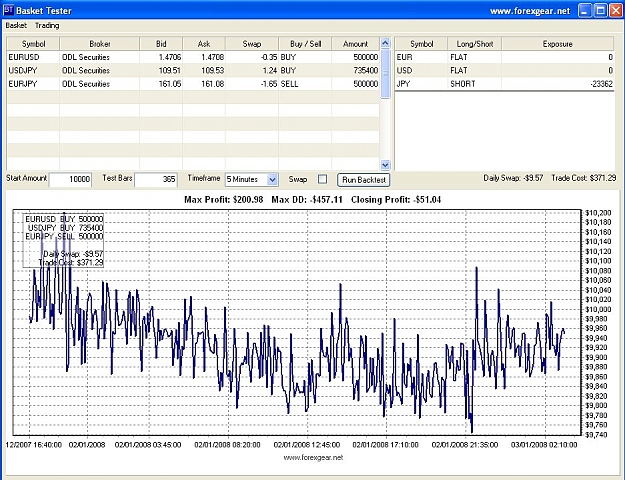

long 1 lot of eur/usd +

long 1 lot of usd/jpy = long 1 lot of eur/jpy ?

(is the ratio of the number of lots correct for a perfect hedge?)

If so, when you hedge them, do they always revert to some mean P/L?

What is the range of +/- P/L like for 1 lot of each?

Which combination of major & cross pairs and brokers give

most discrepencies and thus better for arb opportunities?

long 1 lot of eur/usd +

long 1 lot of usd/jpy = long 1 lot of eur/jpy ?

(is the ratio of the number of lots correct for a perfect hedge?)

If so, when you hedge them, do they always revert to some mean P/L?

What is the range of +/- P/L like for 1 lot of each?

Which combination of major & cross pairs and brokers give

most discrepencies and thus better for arb opportunities?

![Click to Enlarge

Name: 3928120 FxPro - MetaTrader 4 - Demo Account - [EURUSD,M1]_2012-11-28_15-30-30.png

Size: 100 KB](/attachment/image/1088729/thumbnail?d=1365801112)