Ok...No wonder... I missed out the 50ema...

Hmm..I am still not very good in the price action..I have to read more...

Tks...

Hmm..I am still not very good in the price action..I have to read more...

Tks...

DislikedHi Shawn

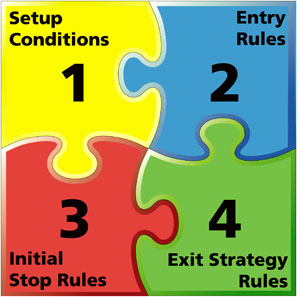

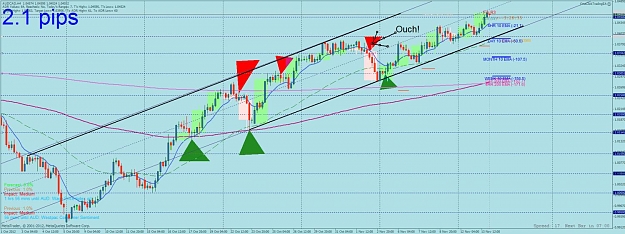

The default template:

1) Normal candles

2) 10 ema

3) 50 ema

4) 200 ema

5) 800 ema

6) and optional TDI (for newbies)

Just stick to these indicators.

This thread is not focus so much on indicators, but on Price Action.

fxDIgnored