DislikedHi mate

not sure which indi you using for piv plots.. there are various ones that you can get where you can set according to your server time and required time calculation.

I use thv4 - you can alter many features, ie standard pivs or fibo pivs, mid levels, price bars, server time setting, offset time for calculation of your pivs etc, also has open, YH, YL, possible shading of yesterday/today etc

I guess many have come across it and using...i have and also pdf info if you require.

cheersIgnored

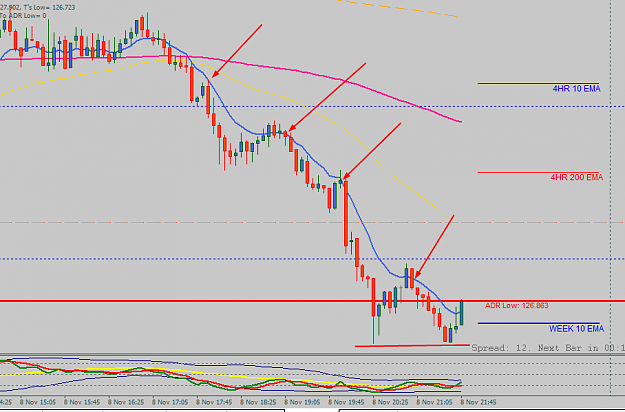

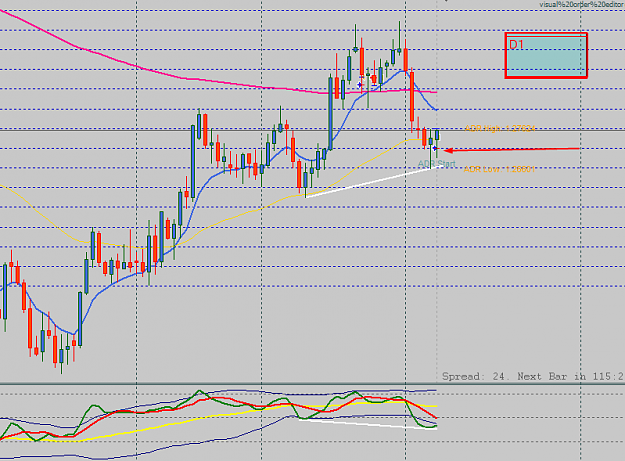

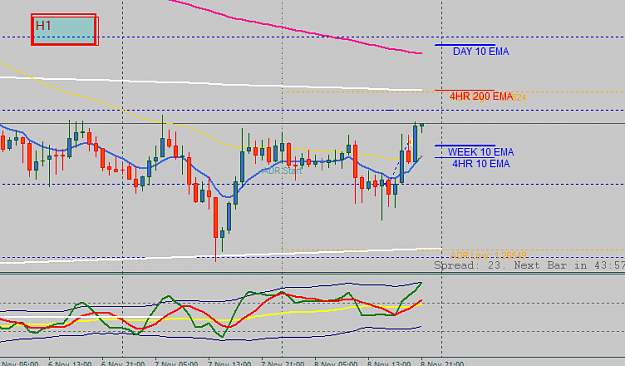

PA and these 3 geometric points where things happen.You can clatter fancy lines all over the chart but means nothing.

Just trying to make people think outside of the box.

In trading, you have to be defensive and aggressive at the same time