LO

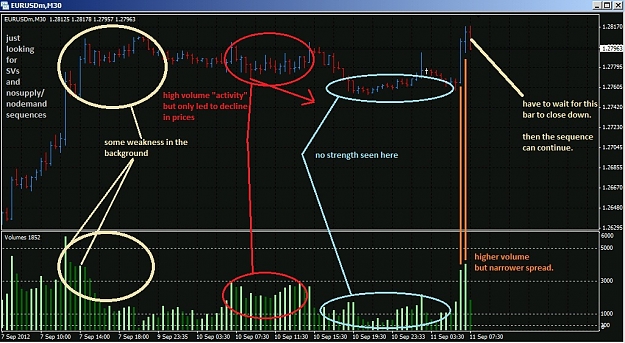

a new question to ask oneself as the day begins is: "what's there to the left of the chart? is there weakness or strength in the background?"

a new question to ask oneself as the day begins is: "what's there to the left of the chart? is there weakness or strength in the background?"