Dislikedhello.. please help

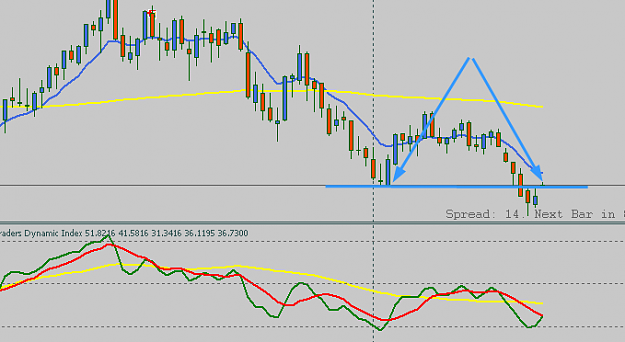

i already set the TDI, but there are no yellow line in my TDI

please help me, how to set the yellow line in TDI ?

thxIgnored

DislikedHi: Looks like a system I could work with. I installed the indicators you posted. There is no Yellow Line on my TDI chart. How can I get one there? ThamksIgnored

Post # 93. answer given Post # 96

DislikedJust been reading the thread looks like a great system loveevery1 will start to follow it very closely.

Im not sure if someone has asked already I have read the whole thread and couldnt find it.

My TDI indie hasnt got the yellow line on it I have had a muck around with it with no luck can anyone help please.

CheersIgnored

DislikedHello,

I have instal the indicators and temple.

TDI i have no yellow line.

What is wrong?

Regards Trader41Ignored

Post # 110, answer given in Post #112,

DislikedHi loveevery1.

I have one issue:

I downloaded yesterday TDI indicator (the one posted here) and I don't have the 3rd line (yellow one).Ignored

and many more until Big Brother wrote this

I see a lot of responses proving that you didn’t read the entire thread before posting.

Maybe...... Try a bit harder and start with post #1, then you will see how this thread grow. That's where I started to learn about this system.

Gibril The Newbie