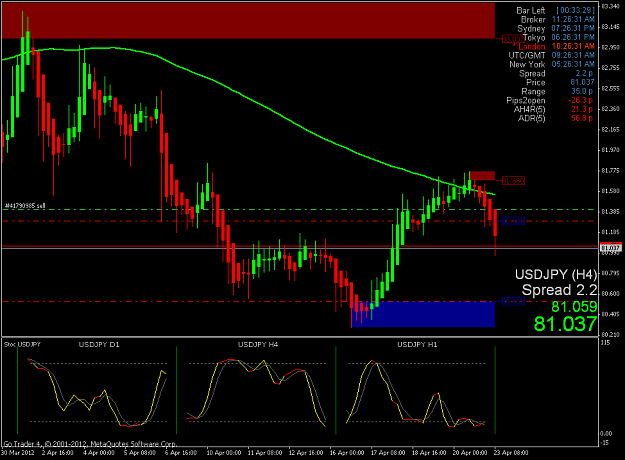

DislikedI am really new to this system - and I am totally all in on what I have seen, love the idea of trading the 4H time frame as it allows to trade in a more flexible range of hours.. Not that I don't love getting up at 4 am. Thank you for your input - I will continue to watch and wait on this pair, I still have a hunch that Monday or Tuesday we may see it slip below SMA and get us some pips... (Will post up a chart when the conditions are a go, if that's cool)

I look forward to becoming an active member of this thread/

Thank you again for the advice...Ignored

- Joined Nov 2011 | Status: the probability trader | 1,110 Posts

Everything is possible!!! Step by Step...

- Joined Nov 2011 | Status: the probability trader | 1,110 Posts

Everything is possible!!! Step by Step...