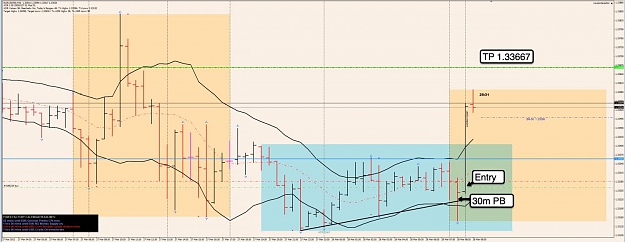

A lot of good confluence there..A good demand level,break of trendline,divergence..

- Post #9,602

- Quote

- Mar 28, 2012 4:48am Mar 28, 2012 4:48am

- Joined Dec 2010 | Status: Never Stop Learning | 5,972 Posts

- Post #9,604

- Quote

- Mar 28, 2012 11:14am Mar 28, 2012 11:14am

- Joined Dec 2010 | Status: Never Stop Learning | 5,972 Posts

- Post #9,607

- Quote

- Mar 29, 2012 6:15am Mar 29, 2012 6:15am

- Joined Jan 2010 | Status: Member | 1,188 Posts

- Post #9,609

- Quote

- Mar 29, 2012 6:47am Mar 29, 2012 6:47am

- | Joined Nov 2011 | Status: Member | 141 Posts

- Post #9,610

- Quote

- Mar 29, 2012 7:02am Mar 29, 2012 7:02am

- Joined Jan 2010 | Status: Member | 1,188 Posts

- Post #9,612

- Quote

- Mar 29, 2012 7:17am Mar 29, 2012 7:17am

- Joined Jan 2010 | Status: Member | 1,188 Posts

- Post #9,613

- Quote

- Mar 29, 2012 7:23am Mar 29, 2012 7:23am

- | Joined Nov 2011 | Status: Member | 141 Posts

- Post #9,615

- Quote

- Mar 29, 2012 7:28am Mar 29, 2012 7:28am

- | Joined Nov 2011 | Status: Member | 141 Posts

- Post #9,616

- Quote

- Edited 7:55am Mar 29, 2012 7:43am | Edited 7:55am

Look for reasons not to take a trade.

- Post #9,617

- Quote

- Mar 29, 2012 8:37am Mar 29, 2012 8:37am

- | Joined Nov 2011 | Status: Member | 141 Posts