Dislikedperhaps his hourly is his "direction" for bigger view of market and its the median of time frames i think.. coz like daily is too big, maybe 4h is too big too. m5 is for timing maybe for what he sees on 5min?Ignored

But that's it they tell me nothing but what happened in the past..

When I get up at the London open I dont look at the 1day to see what the next move is nor the 1H..

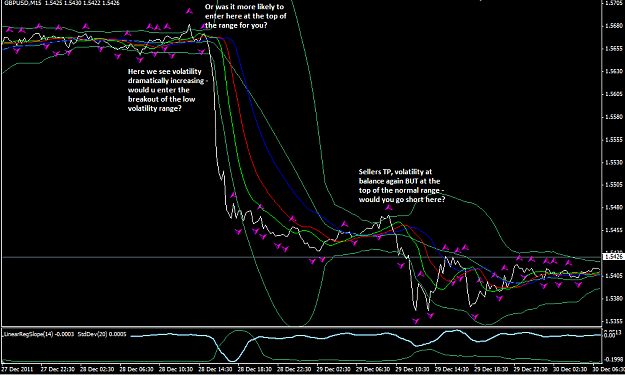

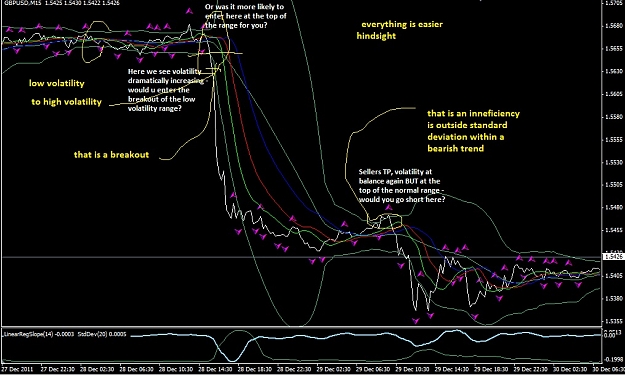

I look at M5 and M15, we see price going up on the M5 then we look at our M15. If we have a buy signal with my system on the M5 and M15 then we take a trade..

I use two TF's for confirmation that the short term trend is now becoming the daily trend, or for the most part of it..

Perhaps you and red like to look at larger time frames to get an indication, I know when I signed up for webinars with my broker thats what they also thought us to do.. But for me its the oppposite...