DislikedI regard the thread starter a friend and I try and respect peoples wishes or thoughts regarding posting first page/post below maybe you missed it ( ha )

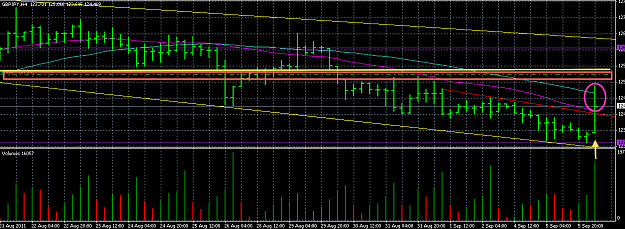

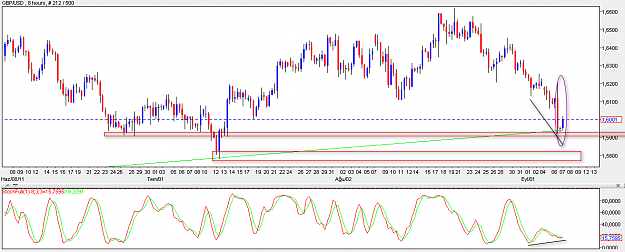

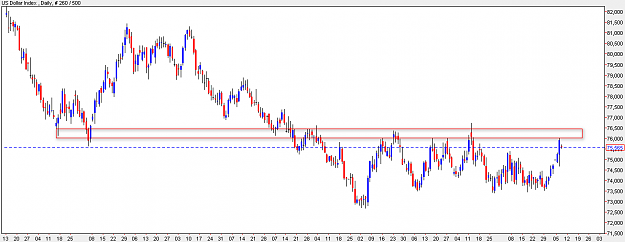

we will freely discuss technical analysis regarding gbp/jpy, gbp/usd, and eur/usd.

constructive discussions are welcome, but no chest thumping activities, and no trade calls. please be logical as possible about your TA when posting. have fun guys.

you have shown no respect for this at all and just recently pk posted what he tried to do in respect to posting which...Ignored

The thread, as well as some others, has now been hijacked by some very arrogant individuals insisting on forcefully changing the threads core beliefs into a thread that they could not have created on their own. That is the reason you need to be vouched for before you can begin a thread in the Forex Factory community.

I can only hope that any senior contributors to the thread will consider taking up where PK left off and begin a thread of your own. The knowledge and experience you have contributed will be greatly missed.

I am not interested in seeing trade calls but useful information about the pair that will allow me to become more knowledgeable on trading this cross make my own trade calls.