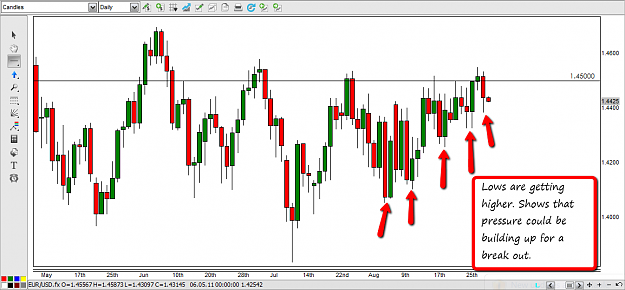

I see that the EUR/USD broke 1.45 overnight. Still hasn't decidedly done it yet. Will be interesting to see what happens during the US session, as Americans only know to sell the Dollar. If it can't get above there and hold during the session......one has to wonder if it even can at this point.

- Post #12,981

- Quote

- Aug 29, 2011 7:54am Aug 29, 2011 7:54am

- | Commercial Member | Joined May 2007 | 7,610 Posts

- Post #12,982

- Quote

- Aug 30, 2011 7:26am Aug 30, 2011 7:26am

- Joined Apr 2008 | Status: Member | 9,414 Posts

- Post #12,983

- Quote

- Aug 30, 2011 8:33pm Aug 30, 2011 8:33pm

- | Commercial Member | Joined May 2007 | 7,610 Posts

- Post #12,984

- Quote

- Aug 31, 2011 8:29am Aug 31, 2011 8:29am

- | Commercial Member | Joined May 2007 | 7,610 Posts

- Post #12,985

- Quote

- Aug 31, 2011 6:01pm Aug 31, 2011 6:01pm

With wisdom comes humility. With humility comes wisdom!

- Post #12,986

- Quote

- Aug 31, 2011 6:46pm Aug 31, 2011 6:46pm

- | Commercial Member | Joined May 2007 | 7,610 Posts

- Post #12,988

- Quote

- Sep 1, 2011 8:07am Sep 1, 2011 8:07am

- | Commercial Member | Joined May 2007 | 7,610 Posts

- Post #12,990

- Quote

- Sep 1, 2011 5:54pm Sep 1, 2011 5:54pm

- | Joined Sep 2011 | Status: Patience | 12 Posts

- Post #12,991

- Quote

- Sep 1, 2011 8:38pm Sep 1, 2011 8:38pm

- | Commercial Member | Joined May 2007 | 7,610 Posts

- Post #12,992

- Quote

- Sep 2, 2011 5:02am Sep 2, 2011 5:02am

- | Joined Sep 2011 | Status: Patience | 12 Posts

- Post #12,993

- Quote

- Sep 2, 2011 8:45am Sep 2, 2011 8:45am

- | Commercial Member | Joined May 2007 | 7,610 Posts

- Post #12,994

- Quote

- Sep 3, 2011 8:29am Sep 3, 2011 8:29am

- | Commercial Member | Joined May 2007 | 7,610 Posts

- Post #12,995

- Quote

- Sep 3, 2011 11:01am Sep 3, 2011 11:01am

- | Joined Sep 2011 | Status: Patience | 12 Posts

- Post #12,996

- Quote

- Sep 3, 2011 5:24pm Sep 3, 2011 5:24pm

- | Commercial Member | Joined May 2007 | 7,610 Posts

- Post #12,997

- Quote

- Sep 4, 2011 12:54am Sep 4, 2011 12:54am

- | Joined Oct 2008 | Status: Member | 1,080 Posts

Grabbing the bull by the horns!

- Post #12,998

- Quote

- Sep 4, 2011 7:40am Sep 4, 2011 7:40am

- | Commercial Member | Joined May 2007 | 7,610 Posts

- Post #12,999

- Quote

- Sep 4, 2011 4:28pm Sep 4, 2011 4:28pm

- | Joined Sep 2011 | Status: Patience | 12 Posts

- Post #13,000

- Quote

- Sep 4, 2011 11:34pm Sep 4, 2011 11:34pm

- | Commercial Member | Joined May 2007 | 7,610 Posts