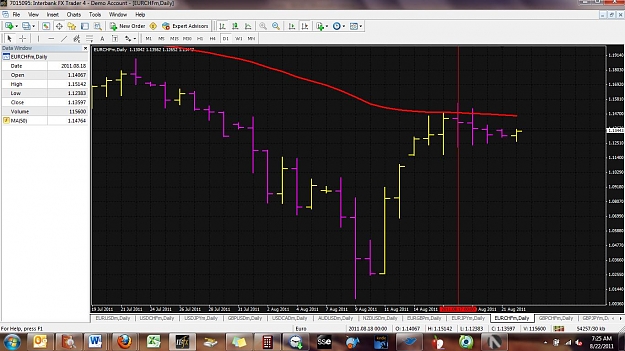

I did not take today's IB on EUR/USD. The reasoning comes from looking at EUR/USD for the past month or so, and what we see is a flat EMA with price doing lots of bouncing around the EMA. This is usually not the best trading environment.

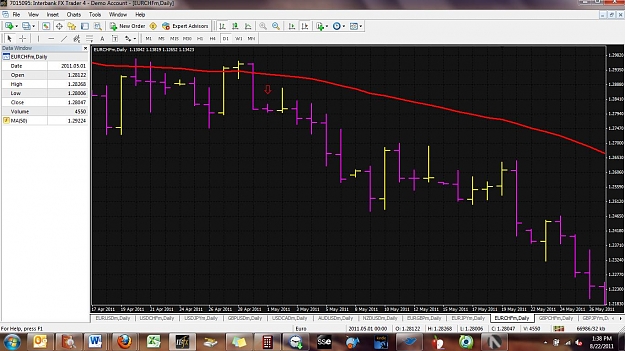

I like to look for a sloping EMA and a bounce off of it, if possible.