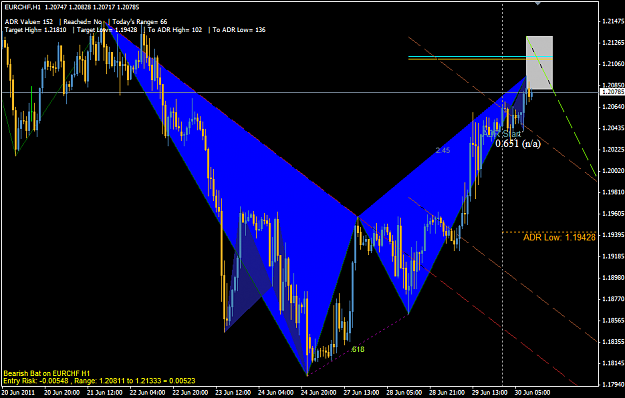

garltey crimson is 1.27abcd @ 786

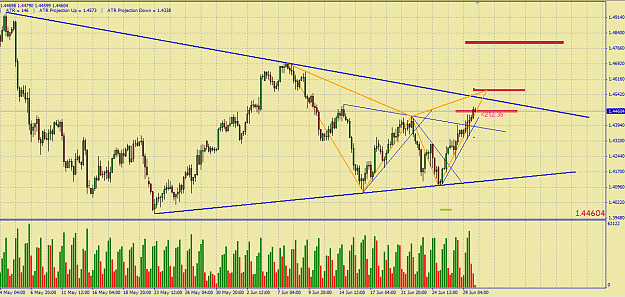

other crimson are ab=cd's which are also tradeable for the right set-up

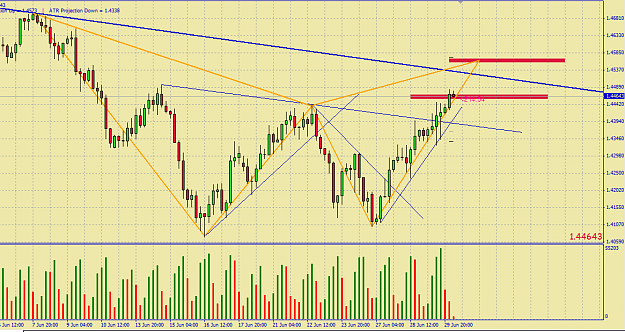

the wedge that is forming up will provide coming opportunities for trading s/r combined with harmonics

Catching a falling knife, no, I'm just trading the Gartley!