Hi scattergood,

Great stuff! Have you looked into bull spread offered by Nadex? Check it out: http://www.igmarkets.com/fx/forex-bull-spreads.html

I have opened a live account with them, and looking into this fascinating bull spread strategy on Forex:

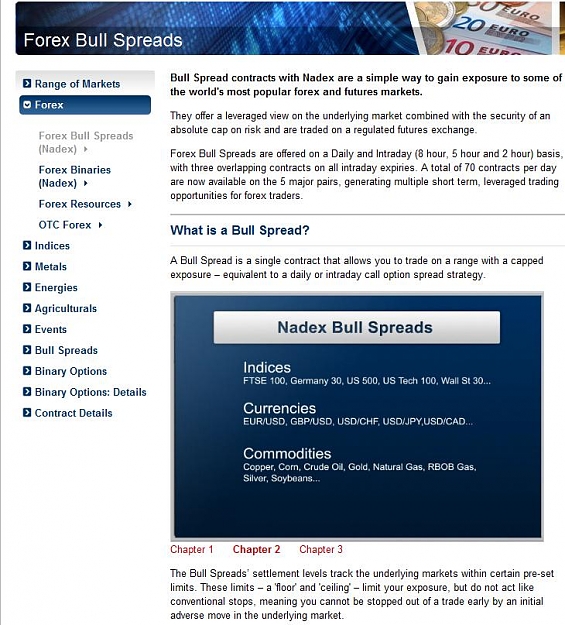

Great stuff! Have you looked into bull spread offered by Nadex? Check it out: http://www.igmarkets.com/fx/forex-bull-spreads.html

I have opened a live account with them, and looking into this fascinating bull spread strategy on Forex: