Hello Guys ,

I ve a question,

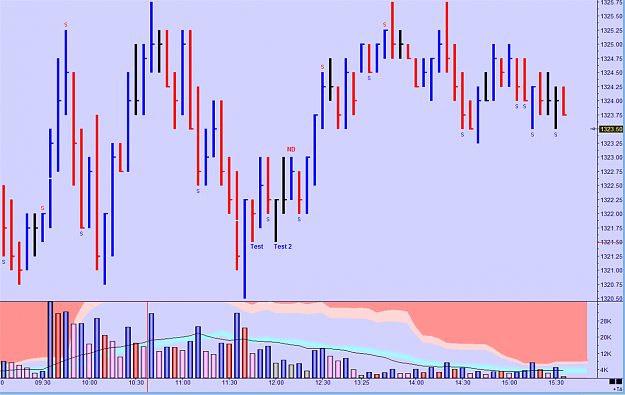

To declare a test successful, what are you looking for ?

After I see a test, I'm waiting for the next bar to close above the high of the test , and I think it will be good to see increasing volume. If the test , is testing the fact that there is no supply, I suppose that you want the next bar with increasing volume . However, most of the time this volume check invalidate a lot of test and a lot of time I miss the move.

I would be very grateful to have some opinions.

thks

Sambo

I ve a question,

To declare a test successful, what are you looking for ?

After I see a test, I'm waiting for the next bar to close above the high of the test , and I think it will be good to see increasing volume. If the test , is testing the fact that there is no supply, I suppose that you want the next bar with increasing volume . However, most of the time this volume check invalidate a lot of test and a lot of time I miss the move.

I would be very grateful to have some opinions.

thks

Sambo